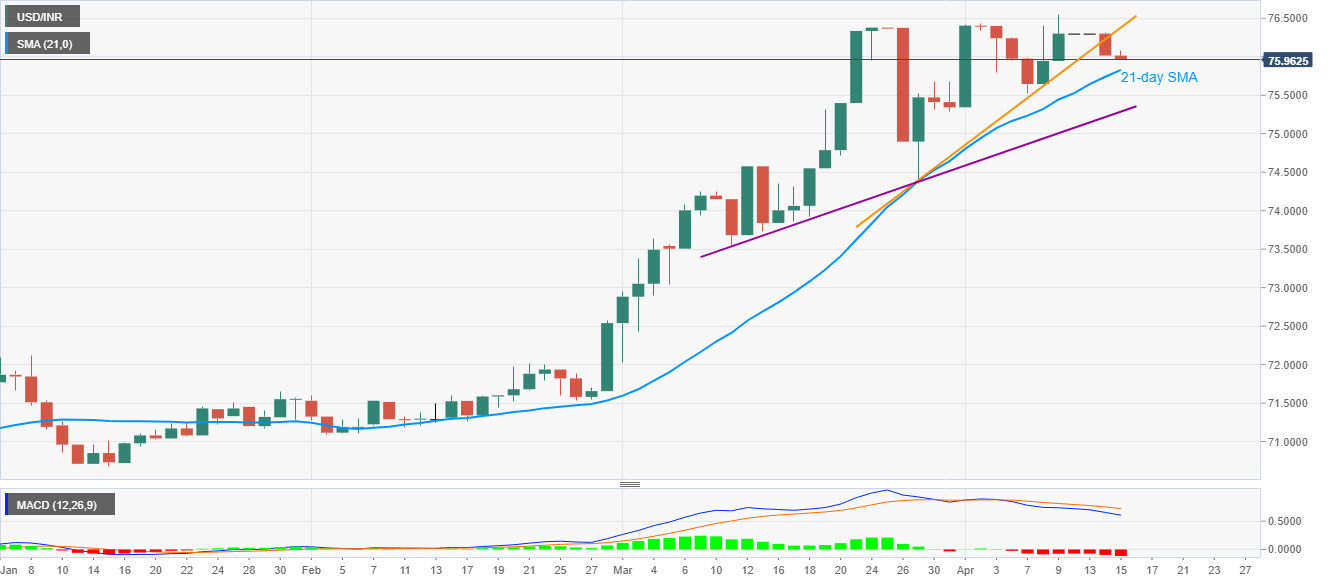

- USD/INR consolidates losses after breaking the 13-day-old trend line.

- 21-day SMA up on the seller’s radar, a five-week-old support line will be watched next.

- Buyers can aim to refresh the monthly top during fresh upside.

USD/INR stays mildly positive, up 0.07% on a day to currently around 76.03, amid the initial trading hour of the Indian session on Wednesday. The pair slipped below multi-day-old ascending trend line the previous day, which together with the bearish MACD signals, favors the sellers.

As a result, a 21-day SMA level of 75.83 becomes the market favorite ahead of an ascending trend line since March 11, 2020, around 75.28 now.

During the quote’s further downside past-75.28, 75.00 and March 27 low near 74.35 may gain the bears’ attention.

Alternatively, buyers may look for fresh entry beyond the support-turned-resistance, at 76.40 now. In doing so, the latest high around 76.56 may offer an intermediate halt to the pair’s run-up towards 77.00.

USD/INR daily chart

Trend: Pullback expected