- USD/INR eked out moderate gains on Wednesday, aborting immediate bearish view.

- Wednesday’s low is the level to defend for the bulls.

- RBI is expected to keep interest rates unchanged.

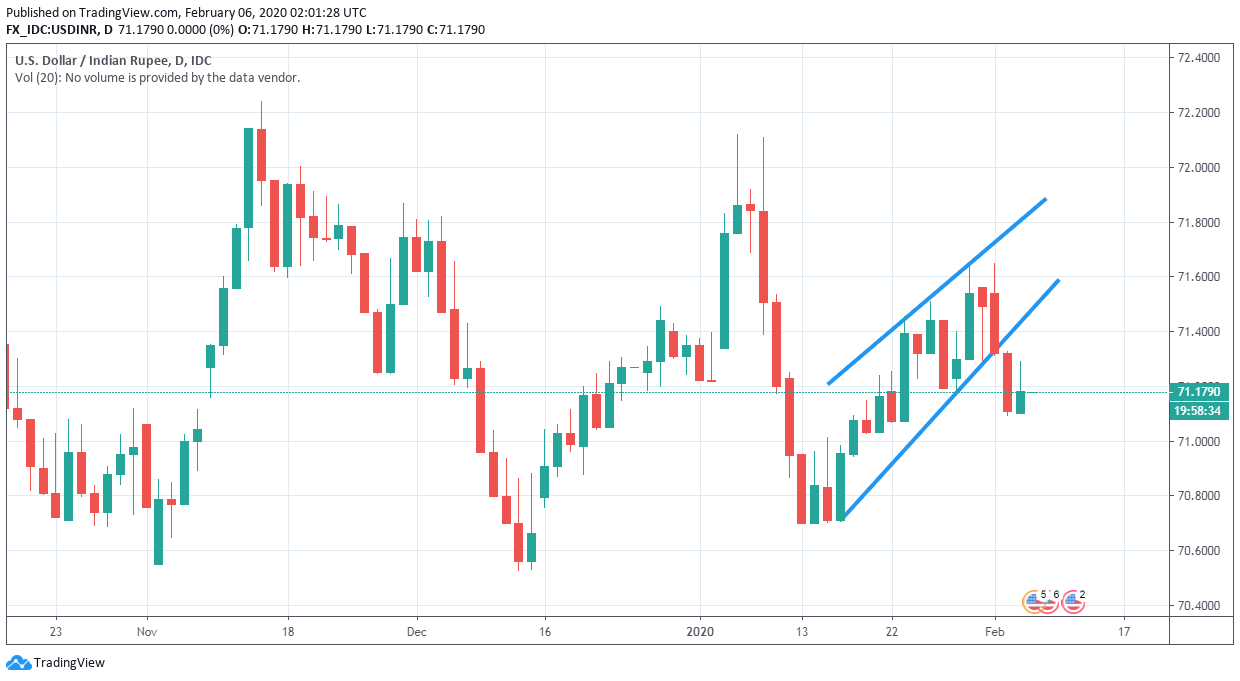

USD/INR pair created an inverted bullish hammer-like candle on Wednesday, pausing the downside (uptick in INR) ahead of the Reserve Bank of India’s (RBI) rate decision.

The pair dived out of an ascending channel on Feb. 4, signaling an end of the bounce from recent lows near 70.70 and scope for a re-test of that level.

Tuesday’s candle has aborted the immediate bearish view and made Wednesday’s move pivotal. Acceptance under the hammer’s low of 71.10 would signal a continuation of the decline toward 70.70. On the other hand, a break above 71.2890 (hammer’s high) would shift risk in favor of a re-test of recent highs near 71.65.

The central bank is widely expected to keep interest rates unchanged at 5.15% as inflation is rising and the government is reportedly struggling to control fiscal deficit.

Notably, the consumer price index shot up to an unexpected five-year high of 7.35% in December.

Daily chart

Trend: Neutral

Technical levels