- USD/INR picks up bids toward the intraday high.

- Bearish candlestick formation, sustained trading below 200-bar SMA highlights two-week-old support line.

- Monthly top adds to the upside barrier before the 74.00 threshold.

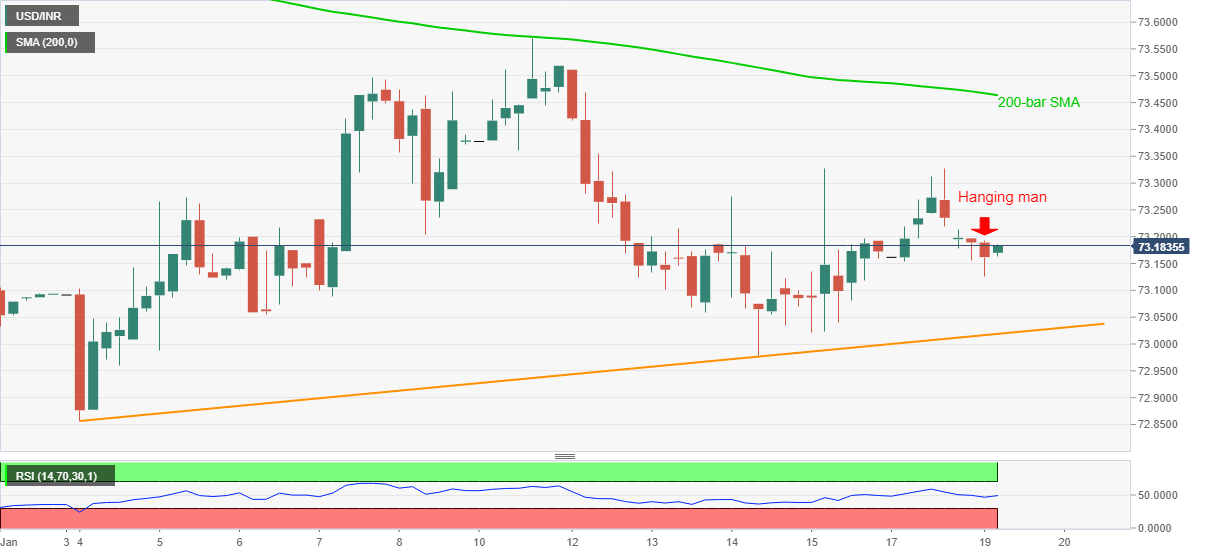

USD/INR trims early Asian losses while rising to 73.18 during the initial Indian session on Tuesday. Even so, the quote fails to convince the buyers as a hanging man bearish candlestick on the four-hour (4H) chart joins extended weakness below 200-bar SMA.

Hence, the latest uptick remains less harmful to USD/INR sellers ahead of 73.20 whereas the previous day’s high around 73.32 adds to the upside filter.

In a case where USD/INR rises past-73.32, the key SMA and the monthly peak, respectively around 73.46 and 73.56, will lure the bulls before highlighting the 74.00 round-figure and December’s high of 74.12.

Meanwhile, an ascending trend line from January 04, at 73.00 now, restricts the short-term downside of the USD/INR prices.

Should the sellers manage to conquer the key support line, the current month’s low near 72.85 will be the key to watch.

Overall, USD/INR is likely to remain depressed unless refreshing them monthly top.

USD/INR four-hour chart

Trend: Bearish