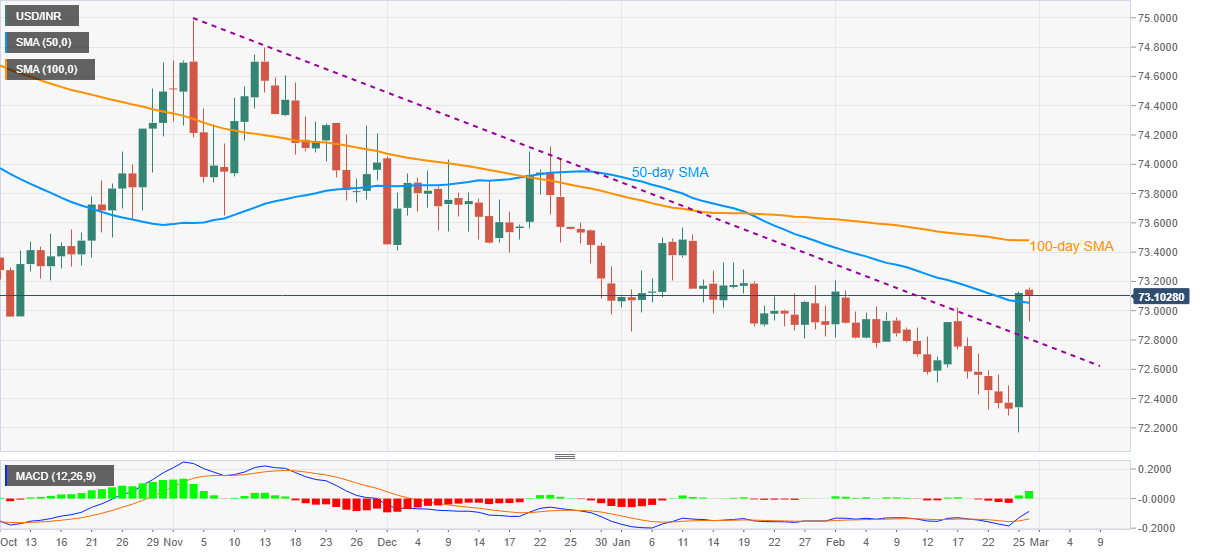

- USD/INR consolidates recent gains around monthly top, clings to 50-day SMA.

- Bullish MACD, sustained break of 16-week-old resistance, now support, favor bulls.

- Sellers need to drop back below the stated trend line to retake controls.

USD/INR prints mild losses while easing from the month’s high to around 73.04 during the initial Indian session on Friday. The quote crossed a downward sloping resistance line from November 04 the previous day. However, 50-day SMA seems to test the bulls off-late.

Considering the bullish MACD joining the sustained trend line breakout, USD/INR is up for further rise but awaits a fresh monthly high above 73.20 to recall the pair buyers.

Following that, the 100-day SMA level of 73.48 and the yearly top around 73.56 will be eyed.

On the contrary, the downside break of the previous resistance line, at 72.80 now, may recall the 72.50 and the 72.30 levels on the chart.

In a case where the USD/INR bears keep dominating past-72.30, the early 2020 tops near 72.20 will add filters to the downside targeting the 72.000 threshold.

USD/INR daily chart

Trend: Further upside expected