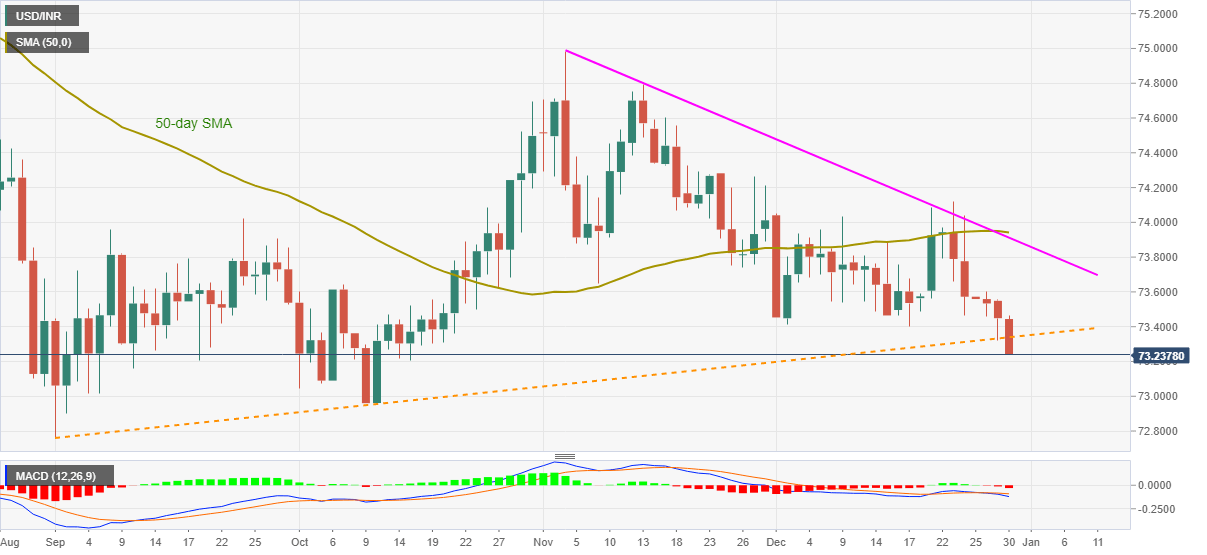

- USD/INR drops to the lowest since mid-October amid broad US dollar weakness.

- Bearish MACD, break of the key support line favor the sellers.

- Eight-week-old falling trend line, 50-day SMA add to the upside filters.

USD/INR stands on the slippery ground while refreshing the multi-day low near 73.24, down 0.27% intraday, during the initial hours of the Indian trading session on Wednesday.

In doing so, the Indian rupee pair extends one-week-old south-run below the key support line stretched from September 01. Also favoring the USD/INR sellers is the bearish MACD signals.

That said, the mid-October lows near 73.20 can offer immediate support to the quote ahead of dragging it to October’s bottom surrounding 72.95. During the fall, the 73.00 round-figure may offer an intermediate halt.

In a case where the USD/INR sellers remain dominant past-72.95, the yearly low marked in September, near 72.76, will regain the market attention.

On the contrary, the quote’s corrective pullback beyond the previous support line, now resistance, around 73.33, may eye another resistance line stretched from November 04, around 73.90. Though, 50-day SMA close to 73.95, followed by the 74.00 round-figure, can challenge the USD/INR bulls afterward.

USD/INR daily chart

Trend: Bearish