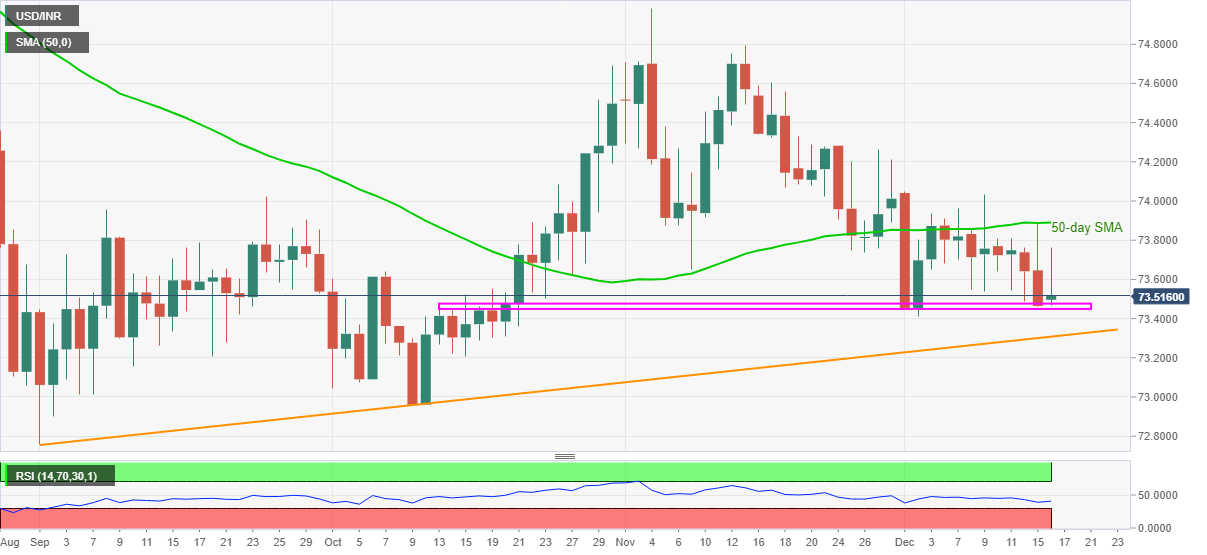

- USD/INR sellers snap two-day downtrend, attack two-month-old horizontal support.

- Sustained trading below 50-day SMA, RSI conditions suggest further downside.

- Ascending trend line from September lures the bears.

USD/INR wavers around 73.50 while trying to defend the short-term horizontal support area during early Wednesday. The pair’s repeated failures to cross 50-day SMA amid an absence of overbought or oversold RSI keeps the sellers hopeful.

Though, a daily closing below the horizontal area established since mid-October, around 73.45/50, becomes necessary to please the USD/INR bears.

Following the quote’s downside break of 73.45, an upward sloping support line from September 01, at 73.30 now, will be the key to watch as it holds the gate for the pair’s further declines.

On the flip side, even the intraday buyers of USD/INR may rethink to take entries before witnessing an upside break of the 50-day SMA level of 73.89.

It should also be noted that the 74.00 threshold adds to the upside filters.

Overall, the bears should remain cautious after a notable dominance for the last one month.

USD/INR daily chart

Trend: Pullback expected