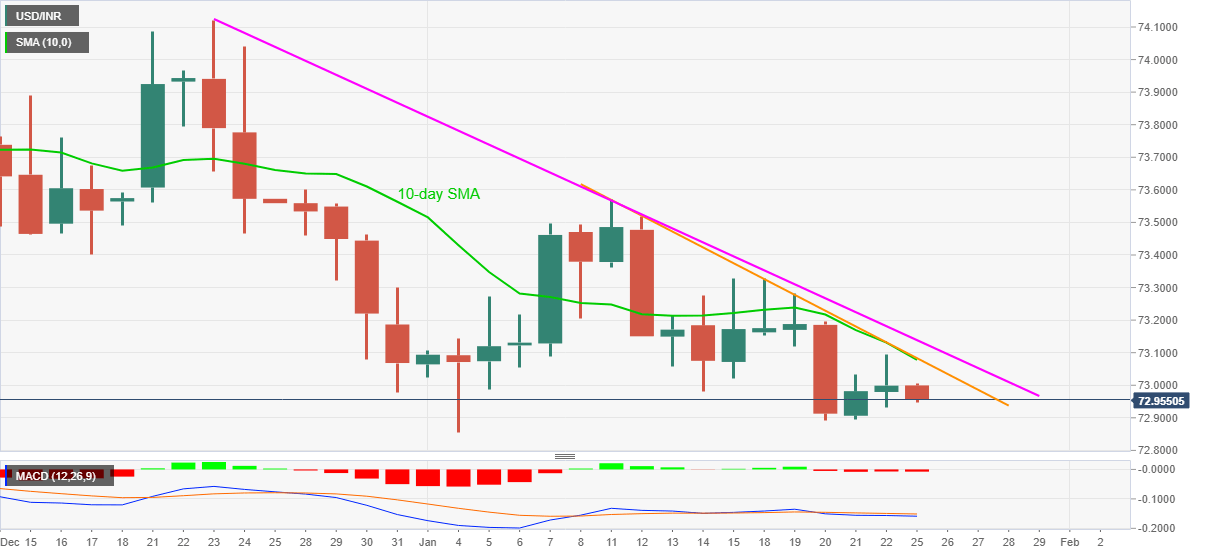

- USD/INR refreshes intraday low after failing to break key upside hurdle.

- 10-day SMA, two-week-old falling trend line favor sellers.

- One-month-long resistance line adds to the upside filters.

USD/INR drops to 72.94, down 0.07% intraday, amid the initial Indian session on Monday. The Indian rupee pair rose for two consecutive days during Thursday and Friday but couldn’t cross 10-day SMA and a descending trend line from January 11.

The resulted move gains cautious optimism in Asia, especially in India, to weigh on the quote. The downside momentum also gets support from the bearish MACD signals.

As a result, USD/INR sellers are again targeting the monthly low of 72.85 and September bottom surrounding 72.75.

If at all the bears manage to conquer 72.75, highs marked during the late 2019 and early 2020 close to 72.25 will gain the market’s attention.

On the flip side, a clear break above 73.07-10 resistance confluence needs validation from a bit longer resistance line near 73.15 to challenge the monthly top of 73.56.

Overall, USD/INR is in a bearish trend but the key supports are likely to challenge the sellers.

USD/INR daily chart

Trend: Bearish