- USD/INR takes the bids near intraday top while again piercing the 73.00 threshold.

- MACD turns bullish, suggesting further recovery towards previous support.

- Bears will wait for fresh low of the month for entries.

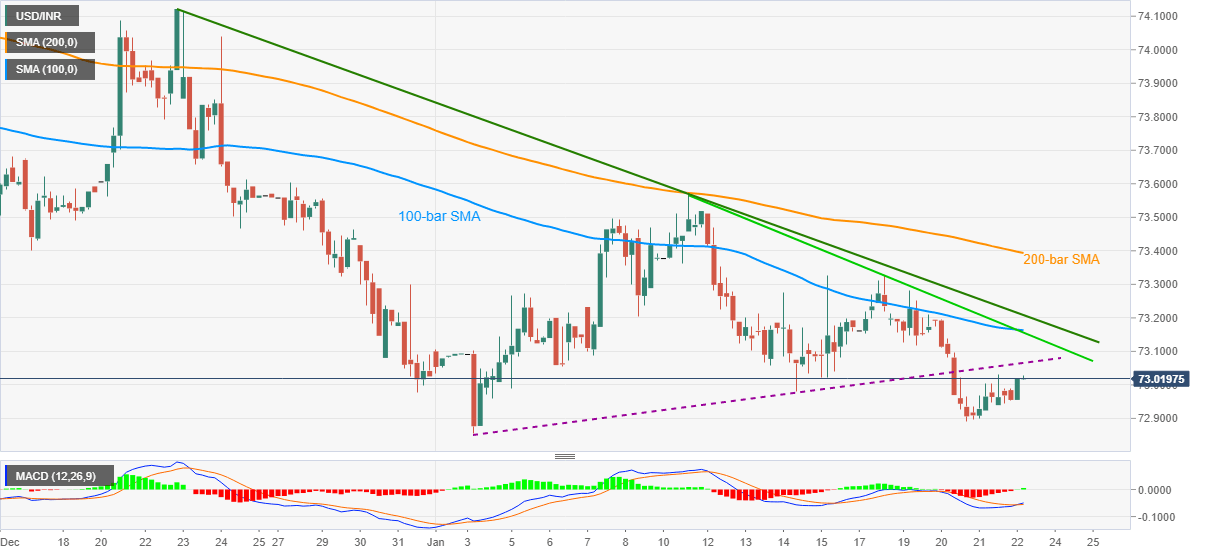

USD/INR rises to 73.02, up 0.06% intraday, during the initial hour of the Indian trading session on Friday. In doing so, the quote teases the key psychological magnet thrice since Wednesday.

However, the flip in the MACD, in favor of the bulls, suggests the quote’s ability to challenge the earlier support line, now resistance, stretched from January 04 near 73.05.

In addition to the immediate resistance line, a downward sloping trend line from January 11 and 100-bar SMA, around 73.15, as well as a one-month-old resistance line, close to 73.20, also challenge USD/INR bulls.

Should the quote rallies past-73.20, 200-bar SMA and the monthly top, 73.40 and 73.56 respectively, will return to the charts.

On the contrary, the weekly low of 72.89 can challenge short-term USD/INR sellers ahead of directing them to the monthly bottom of 72.85. Also acting as a downside filter is September’s low close to 72.75.

To sum up, USD/INR remains in a downtrend even as the latest corrective pullback is likely to stay for now.

USD/INR four-hour chart

Trend: Further recovery expected