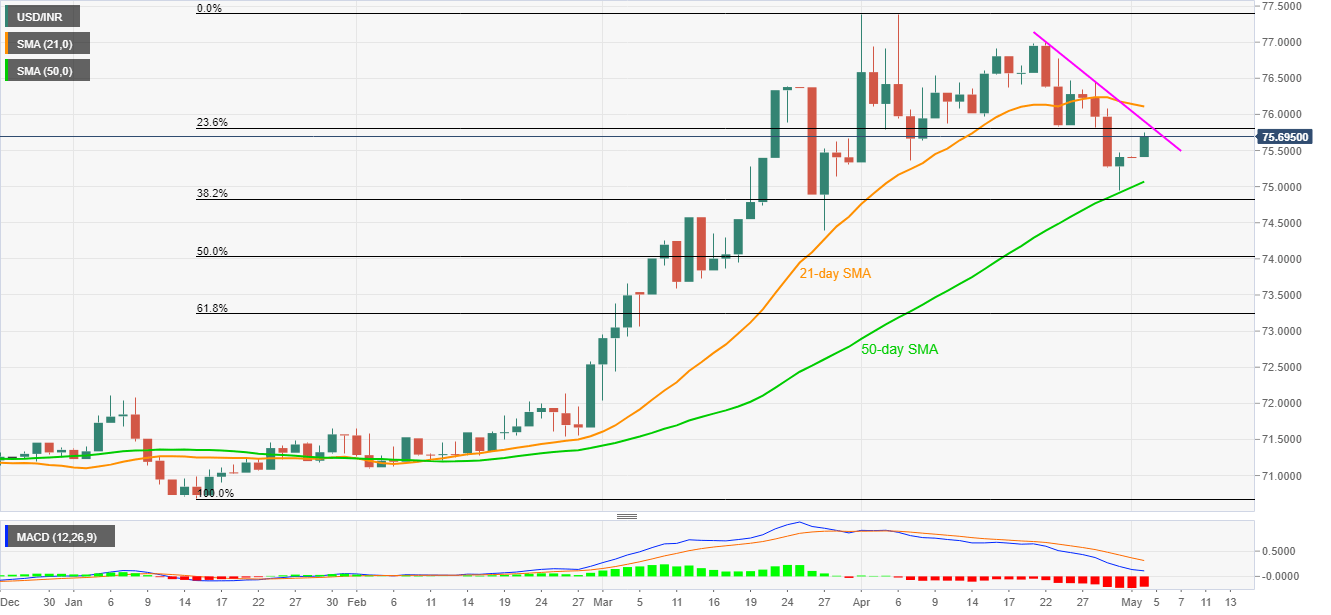

- USD/INR rises 0.50% while extending U-turn from 50-day SMA.

- An eight-day-old falling trend line on the buyers’ radar.

- Sellers can aim for mid-March high under near-term key SMA.

While extending its pullback from 50-day SMA, USD/INR rises to 75.74, up 0.45% on a day, during the pre-European session on Monday.

Even so, a descending trend line from April 22, at 75.90, followed by a 21-day SMA level of 76.11, can check the short-term buyers.

However, a sustained upside past-76.11 enables the bulls to aim for 77.00 ahead of targeting the April month top near 77.40.

On the contrary, a daily closing below 50-day SMA level of 75.05, also breaking the 75.00 round-figure could derail the recovery momentum and can fetch the quote to the mid-March top near 74.58.

USD/INR daily chart

Trend: Bullish