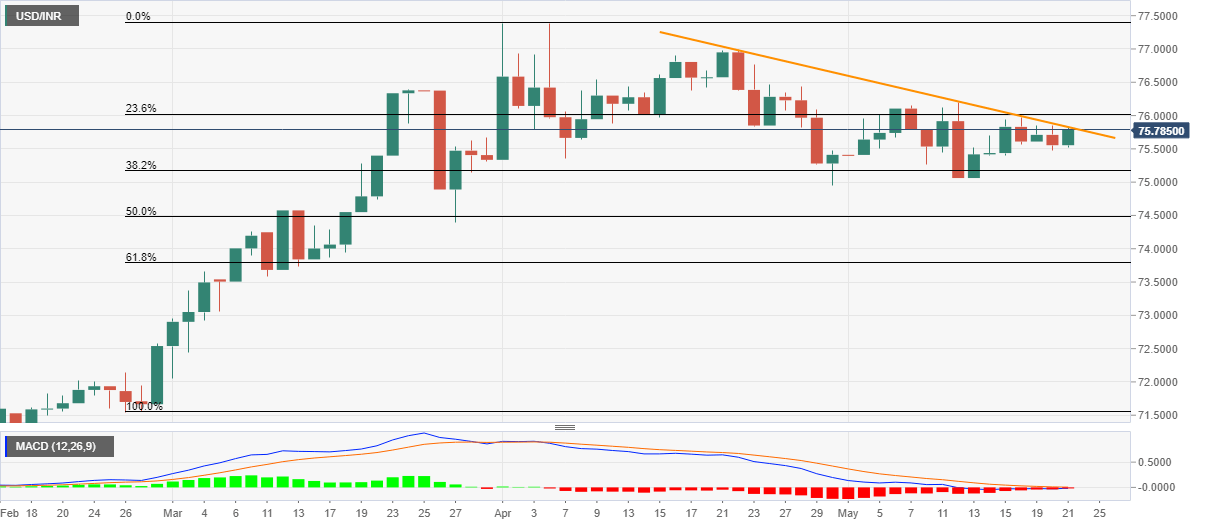

- USD/INR again confronts monthly resistance line while taking the bids near 75.80.

- Bearish MACD suggests repetition of the recent pattern marking loss after the gain.

- An upside clearance can refresh monthly top while bears may have to break April low to mark their strength.

USD/INR takes the bids near 75.80, up 0.32% on a day, while heading into the European session on Thursday. In doing so, the pair confronts the monthly resistance line while also repeating the recent pattern of gain-followed-by-loss on the daily chart.

Not only the short-term trading pattern and immediate resistance line, at 75.85 now, but bearish MACD also cuts down the odds of the pair’s further upside.

As a result, sellers are targeting 75.50 as nearby support ahead of the key April month low near 74.95, a break of which can recall late-March lows near 74.40.

Alternatively, pair’s sustained trading above 75.85 will refresh the monthly top of 76.20 whereas April 21 high of 76.98 and the April monthly peak close to 77.38 could lure the bulls afterward.

USD/INR daily chart

Trend: Pullback expected