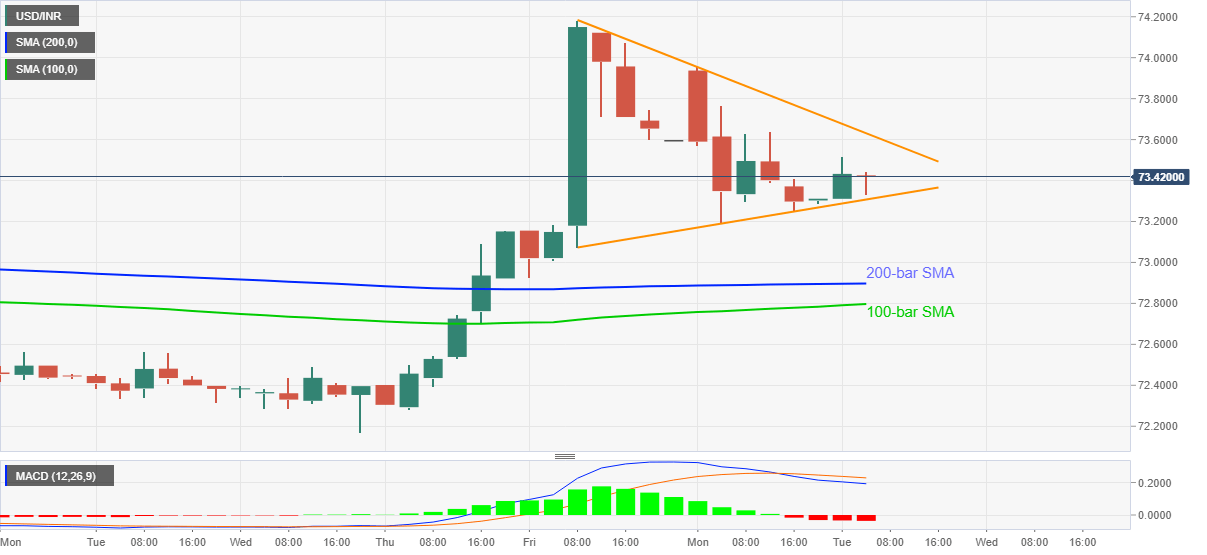

- USD/INR prints mild gains inside a bullish chart pattern.

- Bearish MACD challenges further upside but sustained trading beyond key SMAs keep bulls hopeful.

USD/INR trims early Asian gains while declining to 73.39 during the initial hour of Indian trading on Tuesday. Even so, the pair portrays a bullish chart formation on the four-hour (4H) play.

Although MACD signals challenge the bullish pennant, by suggesting a downside break of pennant support near 73.30, 100-bar and 200-bar SMAs, respectively around 72.90 and 72.80 stand tall to challenge the pair sellers.

Even if the quote manages to break 72.80, multiple barriers around mid-72.00s can stop the USD/INR bears from refreshing the lowest levels since March 2020 of 72.00.

On the flip side, a clear break of the stated pennant resistance, at 73.60 now, will theoretically propel the quote towards the July 2020 top near 75.50. However, November 2020 high near 75.00 will be a tough nut to crack for the USD/INR bulls.

Overall, USD/INR is building the upside momentum after reversing the downtrend during the last week.

USD/INR four-hour chart

Trend: Bullish