- USD/INR stays well bid after confirming a bullish chart pattern.

- Receding bearish bias of MACD directs the run-up towards one-week-old previous support line.

- Pullback moves need to revisit sub-75.00 area to recall the sellers.

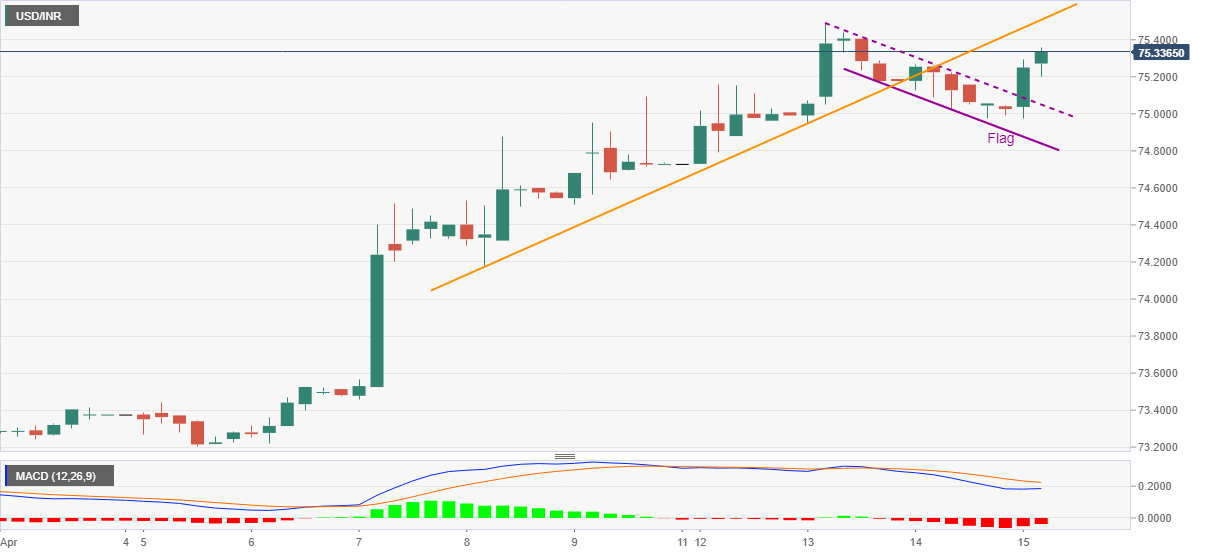

USD/INR remains on the front foot around 75.35, up 0.45% intraday, amid the initial Indian session trading on Thursday. In doing so, the quote defies the recent consolidation by breaking above a short-term falling channel pattern, part of the bullish flag.

The confirmation of a bullish chart pattern joins the receding bearish bias of the MACD to direct USD/INR bulls towards the monthly high, also the highest since July, around 75.50.

However, the quote’s further upside will be tamed by the previous support line from April 08, around 75.50 by the press time.

Meanwhile, the 75.00 threshold restricts the quote’s short-term downside ahead of the flag’s support line around 74.80.

It should, however, be noted that the USD/INR weakness past-74.80 will make it vulnerable to revisit the April 08 low near 74.18 before highlighting the monthly low of 73.16.

USD/INR four-hour chart

Trend: Bullish