- USD/INR picks up bids towards the intraday top.

- Three-week-old support line, February top test sellers ahead of the key SMA.

- Bulls need to stay beyond 75.20 before eyeing 10-month-long horizontal resistance.

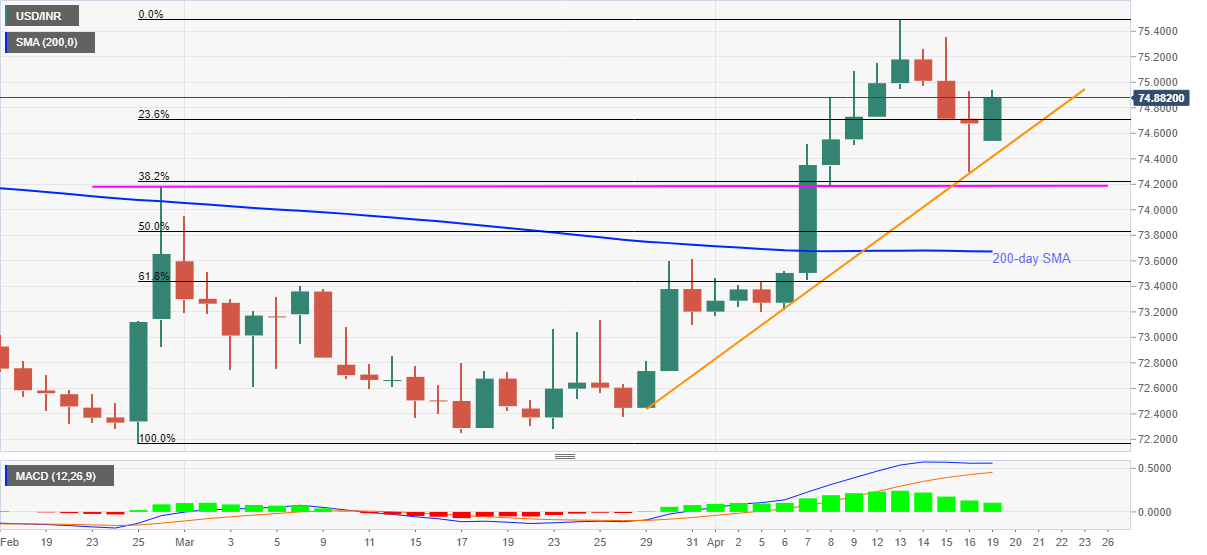

USD/INR buyers are back after three-day off as the quote rises to 74.86, up 0.25% intraday, during the initial Indian trading session on Monday. In doing so, the Indian rupee pair justifies Friday’s bounce off an ascending trend line from March 29.

However, the receding bullish strength of the MACD suggests lesser upside scope for the USD/INR prices.

As a result, the 75.00 threshold and 75.20 gain the major attention of countertrend traders.

Though, a clear break of 75.20 will enable USD/INR bulls to battle the key 75.50 horizontal resistance comprising highs marked since mid-July.

Meanwhile, a downside break of the stated immediate support line, near 74.40, will direct short-term USD/INR sellers toward 74.20.

In a case where the pair drops below 74.20, 50% and 61.8% Fibonacci Retracements of February-April upside, respectively around 73.80 and 73.40, will join 200-day SMA level of 73.67 to test the bears.

Overall, USD/INR is bullish but the further upside will have a bumpy road.

USD/INR daily chart

Trend: Bullish