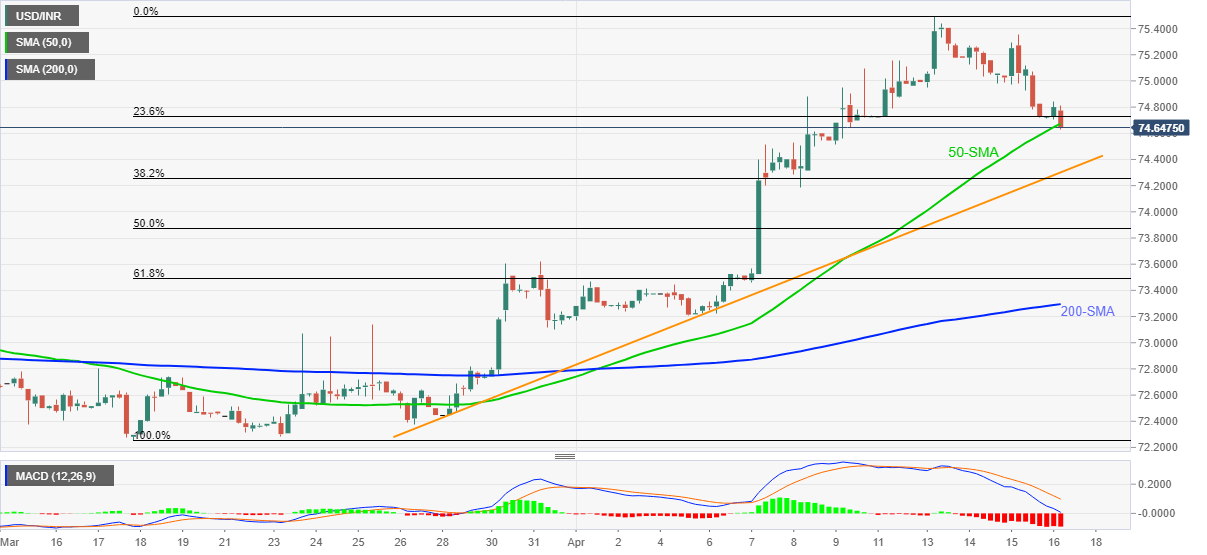

- USD/INR refreshes weekly low as bears battle 50-SMA.

- Bearish MACD, failures to cross 75.50 hurdle favor sellers.

- 200-SMA adds to the downside filters, 75.00 threshold tests corrective pullback.

USD/INR takes offers around 74.63, down 0.11% intraday, amid the initial hour of the Indian trading session on Friday. In doing so, the currency pair justifies pullback from multiple tops marked since mid-July 2020 as sellers attack 50-SMA.

Given the bearish MACD favoring the recent weakness, USD/INR is expected to magnify losses towards an ascending support line from March 28 around 74.30.

However, any further weakness past-74.30 will make the pair vulnerable to revisit the March 31 top near 73.60 and 200-SMA around 73.30.

Meanwhile, fresh recovery moves need to regain the 75.00 round figure to convince the USD/INR buyers. Though, any further upside depends upon how well the quote crosses the 75.50-52 resistance area.

Overall, USD/INR is likely to extend the pullback moves but sellers should remain cautious unless witnessing a clear downside break of the immediate support line.

USD/INR four-hour chart

Trend: Further weakness expected