- USD/INR extends Tuesday’s losses, drops for the fourth week in a row.

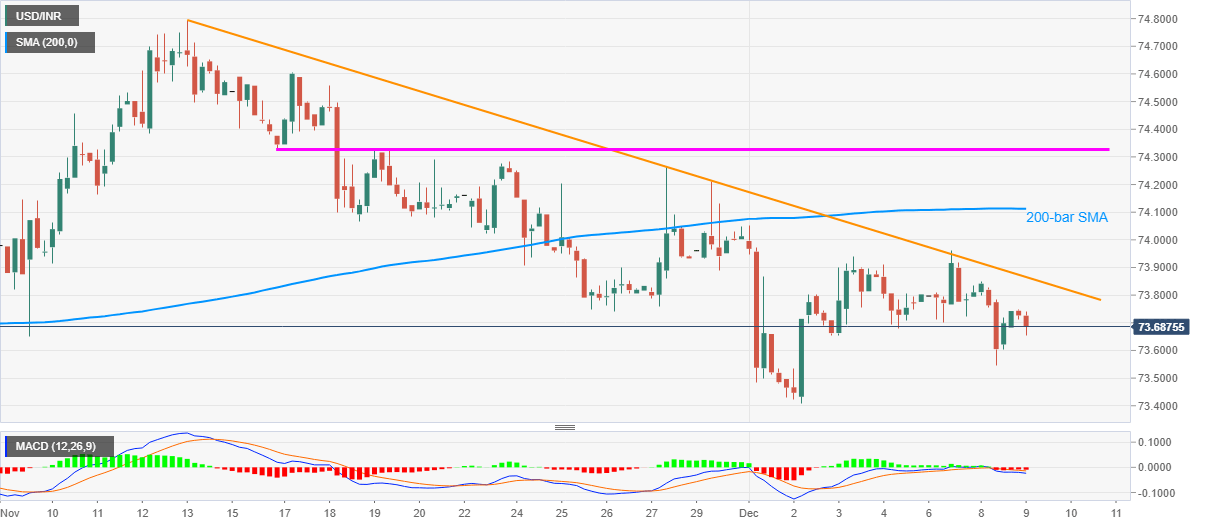

- Bearish MACD signal, sustained trading below key trend line resistance, 200-bar SMA favor pair sellers.

USD/INR drops to 73.67, down 0.05% intraday, ahead of the Indian session open on Wednesday. In doing so, the pair stretches the south-run initiated since late-November.

A downward sloping trend line from November 13 and 200-bar SMA tames the USD/INR upside amid bearish MACD.

As a result, sellers are targeting the monthly low, flashed last Wednesday, around 73.40, during further declines. However, the previous day’s bottom surrounding 73.54 can offer an intermediate halt.

Meanwhile, the aforementioned trend line, at 73.86 now, holds the key to fresh recovery moves towards a 200-bar SMA level of 74.11.

Though, any further upside past-74.11 will have to cross a short-term horizontal resistance near 74.30/35 before challenging the last month’s peak near 74.80.

USD/INR four-hour chart

Trend: Bearish