- Sustained trading beyond May month top propels USD/INR to an eight-month high.

- 23.6% Fibonacci retracement questions immediate upside amid overbought RSI.

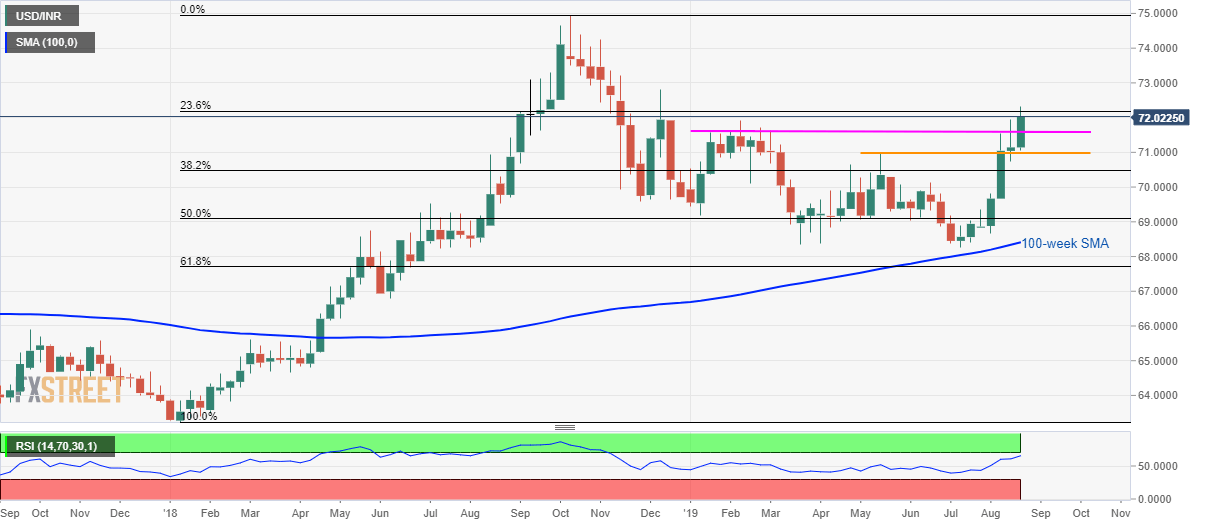

Despite rallying to the fresh yearly highs, USD/INR fails to successfully cross 23.6% Fibonacci retracement of January 2018 swing low to October 2018 swing high. The quote currently takes the rounds to 72.00 while heading into the European session on Friday.

Other than failure to grow past-23.6% Fibonacci retracement level near 72.20, overbought conditions of 14-bar relative strength index (RSI) also raise doubts on the pair’s further upside.

As a result, the 71.55/50 horizontal support gains short-term sellers’ attention as a break of which can drag the pair to May month high close to 71.00.

On the upside, a sustained trading pattern beyond 72.20 enables buyers to target December 2018 high of 72.82 whereas 73.50, November 2018 top at 74.26 and 74.96 can please the bulls afterward.

USD/INR weekly chart

Trend: Pullback expected