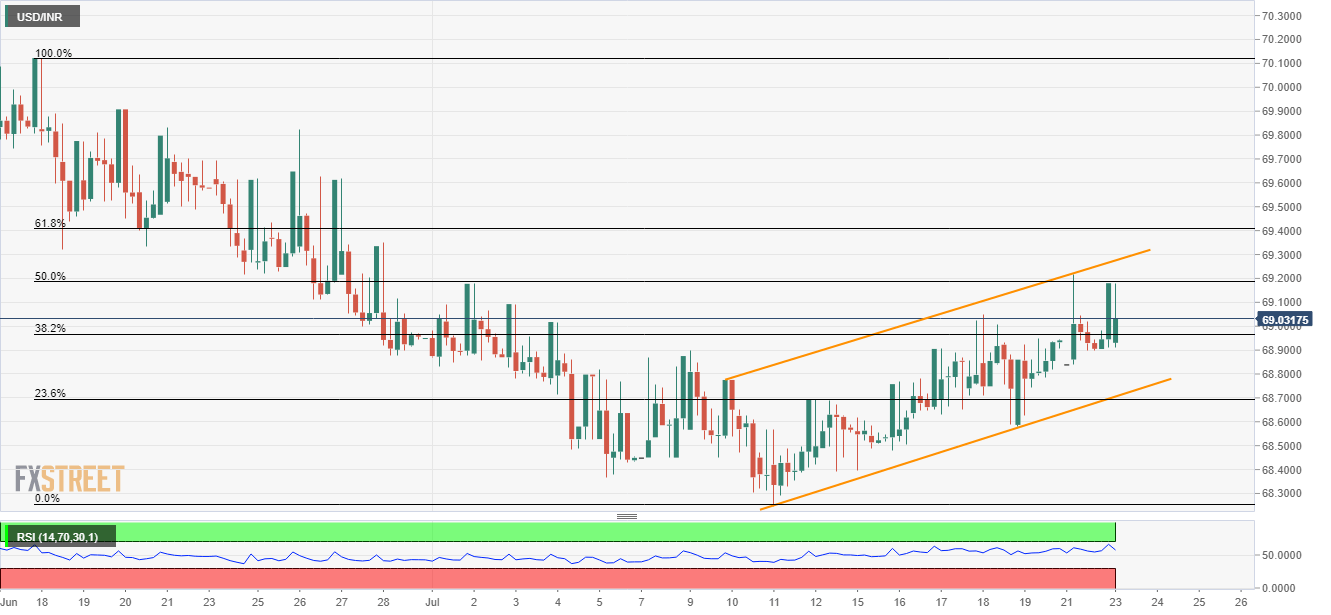

- Overbought RSI shows buyers’ exhaustion during gradual recoveries from the multi-month low.

- Sellers await downside break of the short-term rising channel.

Although 50% Fibonacci retracement of mid-June to early July downpour limits the USD/INR pair’s immediate upside, short-term ascending trend-channel portrays the underlying momentum strength as the quote seesaws near 69.02 on early Tuesday.

Given the overbought conditions of 14-bar relative strength index (RSI), sellers are waiting to enter on the downside break of 68.70/69 comprising 23.6% Fibonacci retracement and channel’s lower-line.

In doing so, 68.36 and 38.25 could be their intermediate halts while targeting 68.00 during further declines.

Alternatively, the channel resistance of 69.27 can limit the pair’s upside past-50% Fibonacci retracement level of 69.19.

It’s worth noting that the quote’s rise beyond 69.27 enables it to challenge late-June highs surrounding 69.83.

USD/INR 4-hour chart

Trend: Pullback expected