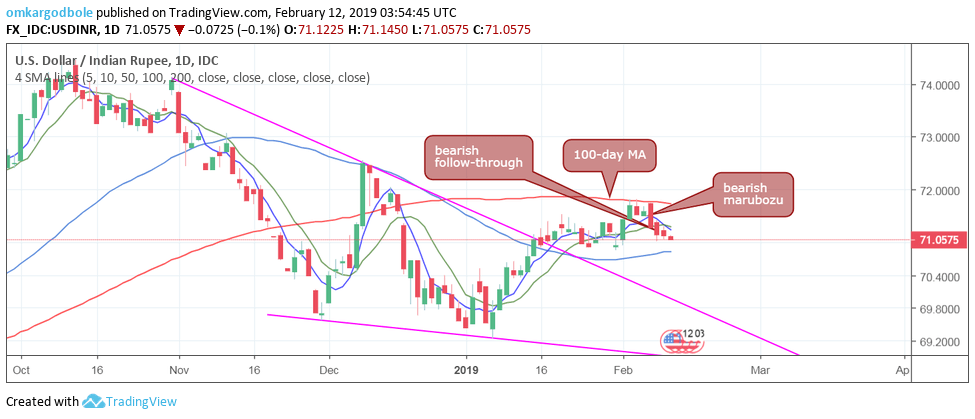

The USD/INR pair managed to avoid a break below 71.00 for two straight days, but the probability of a deeper drop below that psychological level still remains high as the resistance at 71.29 (low of the Thursday’s bearish marubozu candle) is intact.

Daily chart

The 5-day moving average (MA) has crossed the 10-day MA from above, reinforcing the bearish view put forward by the bearish marubozu candle carved out last Thursday.

The pair, therefore, risks falling to 70.84 (50-day moving average). A close above 71.29 would invalidate the bearish setup.

4-hour chart

The rising wedge breakdown, as seen in the chart above, also supports the bearish view put forward by the daily chart.

Hourly chart

The pair may revisit 71.20 if the RSI finds acceptance above the falling trendline. That bounce, however, could be short-lived, courtesy of the bearish setup on the daily chart.

Trend: bearish

-636855405880973257.png)

-636855406129103379.png)