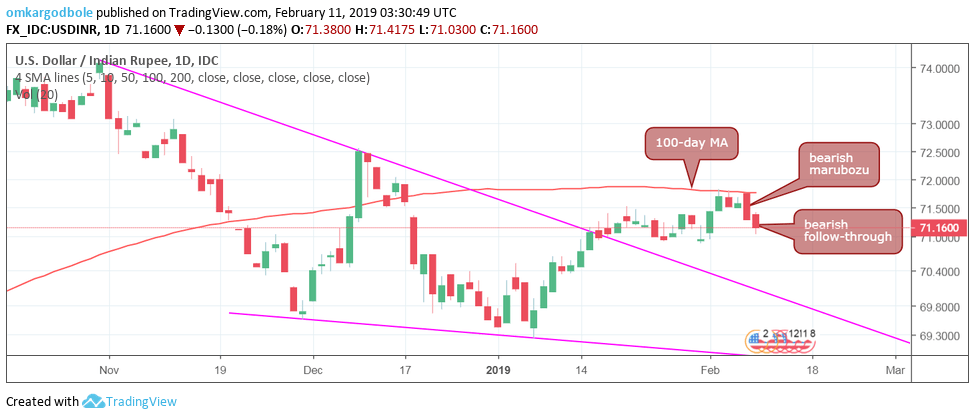

- USD/INR closed well below 71.29 (Thu’s low) on Friday, validating the repeated rejection at the 100-day moving average (MA) hurdle and Thursday’s bearish marubozu candle.

- The pair, therefore, risks falling to 70.86 (Jan. 31 low) this week. A close below that level would only bolster the bearish setup and expose the support lined up at 70.52 (Jan. 3 high).

- Bearish pressures would weaken if the spot finds acceptance above 71.29. The outlook would turn bullish above the 100-day moving average (MA), currently at 71.76.

Daily chart

Trend: bearish

USD/INR

Overview:

Today Last Price: 71.245

Today Daily change: 0.0750 pips

Today Daily change %: 0.11%

Today Daily Open: 71.17

Trends:

Daily SMA20: 71.1902

Daily SMA50: 70.8221

Daily SMA100: 71.7593

Daily SMA200: 70.3975

Levels:

Previous Daily High: 71.59

Previous Daily Low: 71.015

Previous Weekly High: 71.915

Previous Weekly Low: 71.015

Previous Monthly High: 71.64

Previous Monthly Low: 69.185

Daily Fibonacci 38.2%: 71.2346

Daily Fibonacci 61.8%: 71.3704

Daily Pivot Point S1: 70.9267

Daily Pivot Point S2: 70.6833

Daily Pivot Point S3: 70.3517

Daily Pivot Point R1: 71.5017

Daily Pivot Point R2: 71.8333

Daily Pivot Point R3: 72.0767