- INR weakens ahead of India’s budget announcement.

- USD/INR’s technical charts are biased bearish.

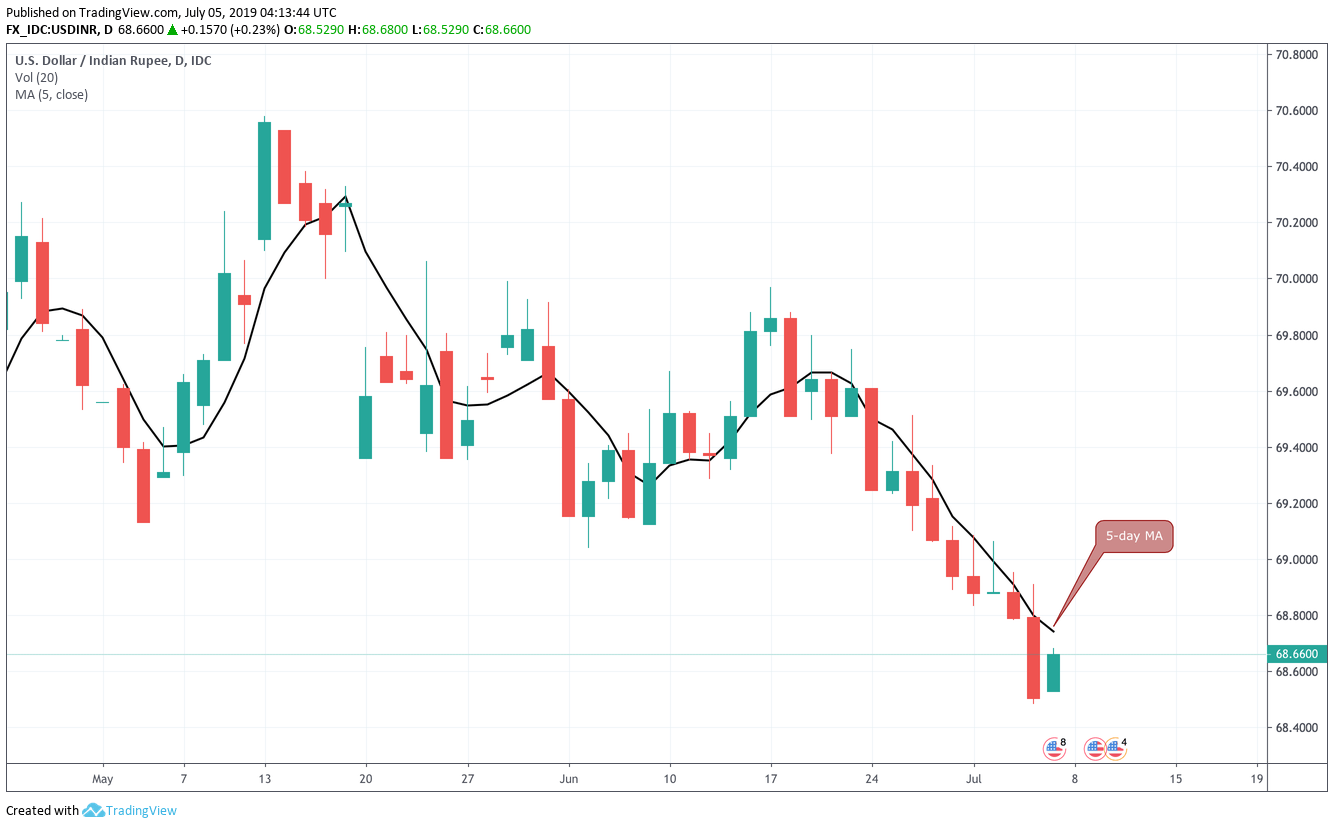

The USD/INR pair is currently trading at 68.63, having hit a low of 68.48 on Thursday.

The early gains could be associated with the oversold conditions reported by the hourly and 4-hour chart relative strength index.

The corrective bounce could be extended further to the descending 5-day moving average (MA), currently at 68.73.

The outlook, however, will remain bearish as long as the pair is held below 69.61 – the high of the previous week’s bearish marubozu candle, as discussed on Thursday.

A strong rejection at the 5-day MA of 68.73 could yield a drop to the support at 68.35 (March low). A violation there would expose the next major support at 67.00.

India’s Finance Minister Nirmala Sitharaman will be announcing her first budget today. The budget is widely expected to boost spending and provide tax relief. At the same time, Sitharaman is expected to keep expenditures in check.The INR will likely gain on pro growth budget, pushing the USD/INR down to 68.35.

The US non-farm payrolls and average hourly earning data is scheduled for release at 12:30 GMT today. A big beat on expectations would weaken the prospects of aggressive rate cuts by the Federal Reserve cuts, sending the US Dollar higher across the board. The USD/INR, therefore, could open higher on Monday.

On the other hand, a gap down opening could be seen if the US data disappoints expectations. It is worth noting that markets are priced in for at least two Fed rate cuts this year.

Daily chart

Trend: Bearish

Pivot points