- USD/INR created bearish marubozu candle last week.

- The pair risks falling to 68.35 in the short-term.

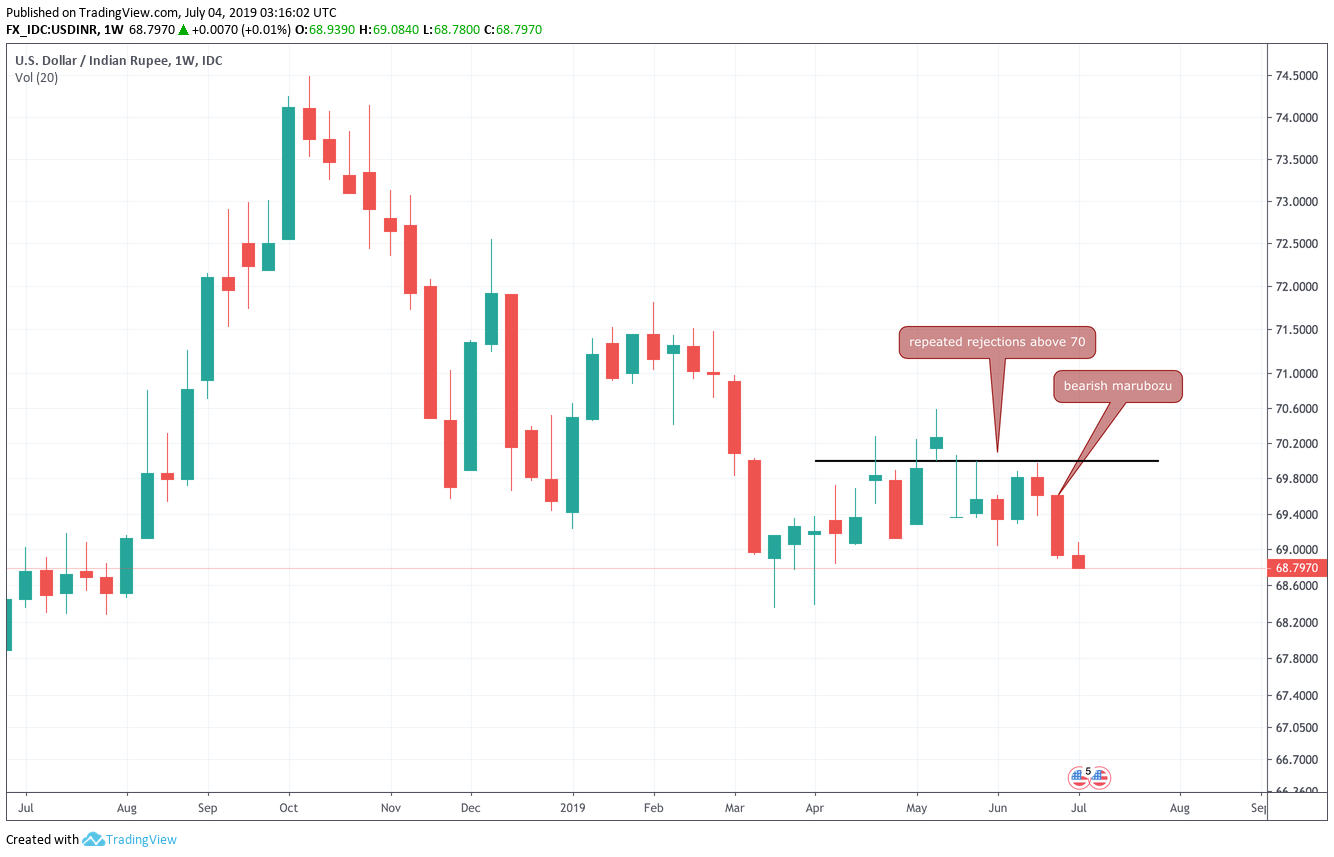

USD/INR appears on track to test the low of 68.35 seen in March, having created a bearish marubozu candle last week.

A bearish marubozu is a strong indication of bearish reversal or continuation of the sell-off depending on where it appears.

In USD/INR’s case, the candlestick appeared following weeks of rejections around 70.00 and signals a bearish reversal or an end of the corrective bounce from the March low of 68.35.

More importantly, the follow-through to the bearish marubozu has been negative so far this week. The pair closed at 68.60 yesterday – below the bearish candle’s low of 68.939.

As a result, the pair could revisit 68.35 in the short-term. The bearish case would weaken if and when the pair rises above the previous week’s high of 69.61. Meanwhile, a weekly close move 70 is needed to confirm a bullish reversal.

Weekly chart

Trend: Bearish

Pivot points