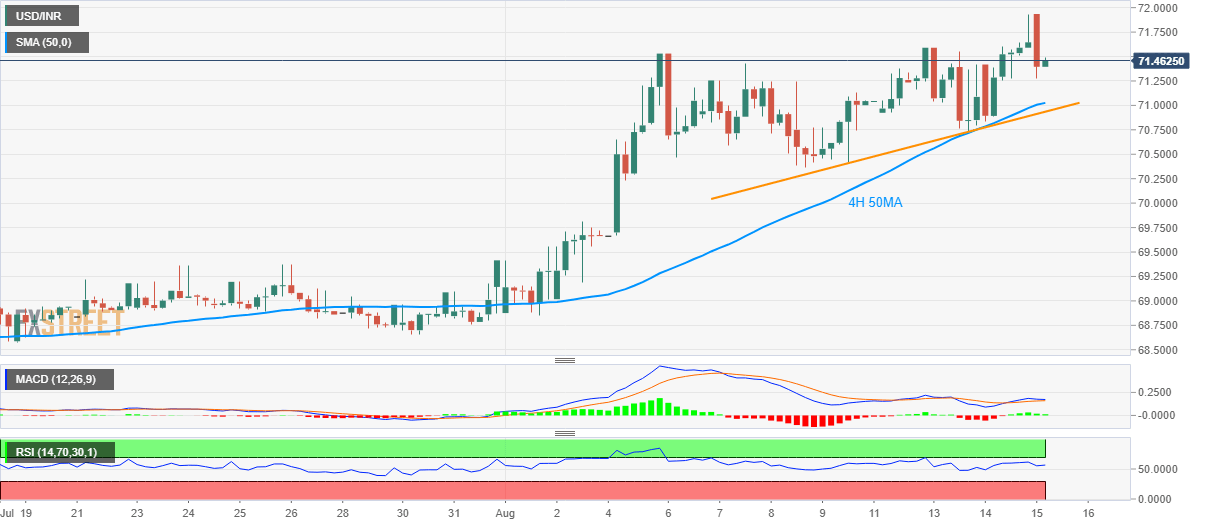

- USD/INR remains strong above 4H 50MA, four-day-old ascending trend-line.

- Further buying interest prevails as key technical indicators show bullish signal.

The pullback from 71.93 is less likely to disappoint USD/INR buyers unless breaking short-term key supports. The quote trades around 71.47 by the press time ahead of Thursday’s European session.

The 50-bar simple moving average on the four-hour chart (4H 50MA) and a four-day long rising trend-line, at 71.0258 and 70.9350, seem nearby key supports to watch in a case the quote declines further.

Should prices slip under 70.9350, August 05 low around 70.2328 may question sellers ahead of pleasing them with the 69.80 and 69.40 rest-points.

Given the bullish signal by 12-bar moving average convergence and divergence (MACD), coupled with normal conditions of 14-bar relative strength index (RSI), momentum is likely to remain strong.

In doing so 71.9350 and 72.00 can provide immediate resistance while December 2018 peak near 72.82 may play its role then after.

USD/INR 4-hour chart

Trend: Bullish