The USD/JPY analysis failed to stay in the buyer’s territory, and now it could stabilize under the immediate support levels. DXY and JP225’s decline forced the pair to pare off gains. The bias is still bullish in the short term, but we need strong confirmation that the pair may resume its upwards movement.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The Japanese data came in mixed today. The BOJ Core CPI increased by 0.1% versus 0.0% expected compared to 0.0% in the previous reporting period. Furthermore, the Flash Manufacturing PMI dropped unexpectedly from 52.4 to 52.2 even if the analysts expected a rise to 53.1 points.

The Greenback needs strong support from the US economy to resume bullish trend. The New Home Sales will be released soon, but I don’t think this indicator could change the sentiment.

The US CB Consumer Confidence could have a big impact tomorrow. The indicator is expected to drop from 127.3 to 124.2 points.

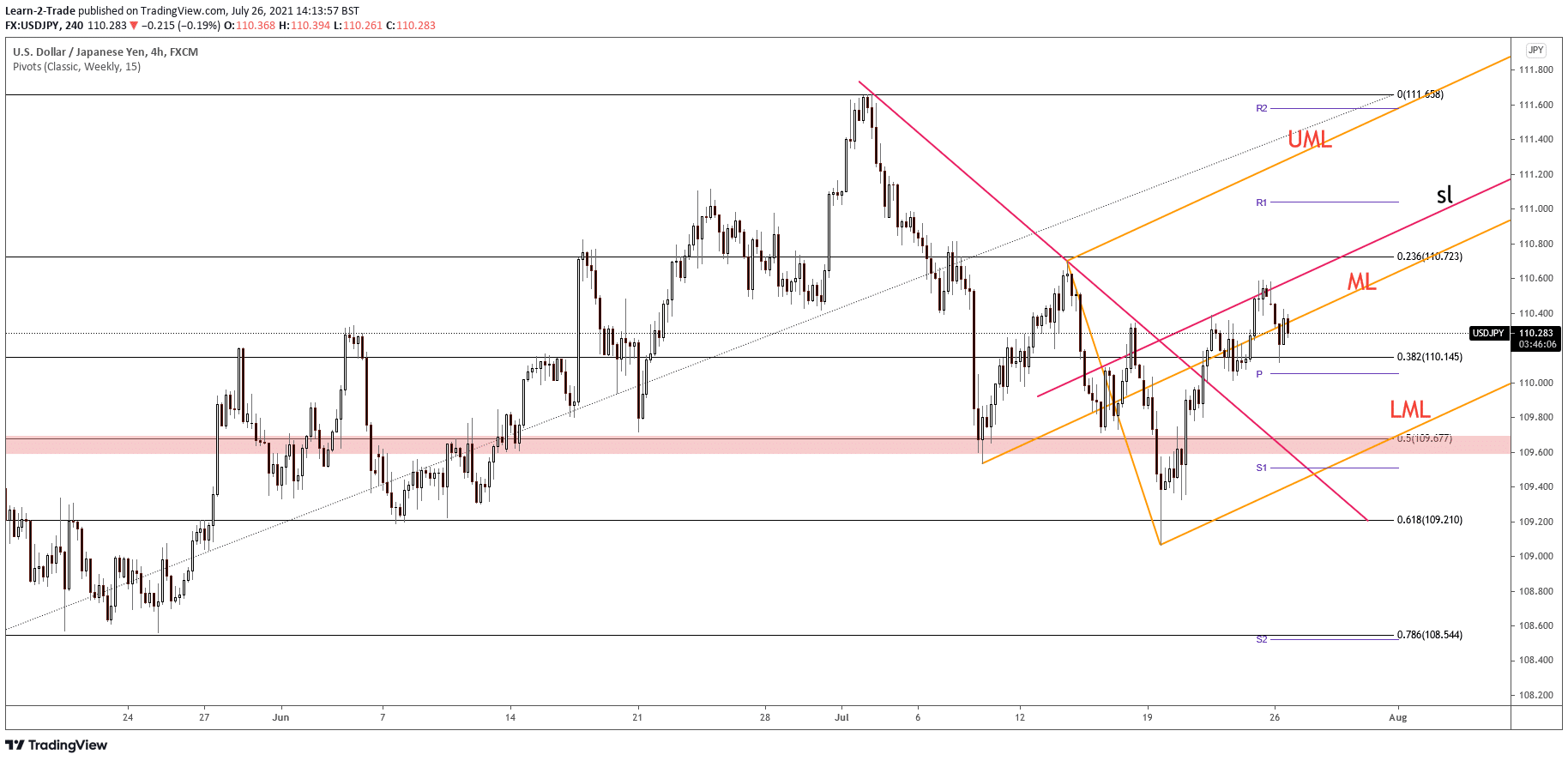

USD/JPY technical analysis: Bears to gain traction

USD/JPY found strong resistance at the ascending pitchforks inside the sliding line (SL). Now it continues to challenge the median line (ML). Stabilizing under this line could indicate a strong bearish pressure.

DXY’s further drop caused by some poor US data or by dovish FED could force the pair to drop significantly. On the other hand, USD/JPY stands above the 38.2% retracement level and far above the weekly pivot point (110.05).

–Are you interested to learn about forex bonuses? Check our detailed guide-

It could still rise as long as it stays above these levels. Developing a sideways movement could indicate that USD/JPY tries to attract more bullish energy before jumping higher. JP225 and DXY’s growth could boost the pair.

Registering a downside breakout through the weekly pivot point (110.05) could really signal a deeper drop towards the ascending pitchfork’s lower median line (LML).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.