Dollar/yen finally made a move and it was down. A small surprise from the BOJ and lots ofUSD weakness, now originating from China, were the main culprits. Will the pair fall even lower?

USD/JPY fundamental movers

Mini tantrum, Chinese worries

The Bank of Japan surprised with an experiment in the bond market, raising concerns that it is about to tighten. The BOJ has the loosest monetary policy in the developed world and any hint that it may taper bond buying causes jitters and strengthens the yen.

The US dollar suffered from a report that China may slow or totally halt buying US Treasuries. The greenback suffered and only partially recovered when China partially denied it.

Inflation in the US is not so impressive but despite a beat, the publication unleashed a fresh wave of dollar selling that sent USD/JPY to hardly hold onto 111.

Housing data, consumer sentiment

The upcoming week sees a double-feature of housing data from the US. Building permits and housing starts often offset each other but last month they both surprised to the upside, boosting the dollar. In addition, watch out for consumer sentiment late on Friday. In Japan, the PPI is worth noting, but it seems that only reports about the BOJ can move markets.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

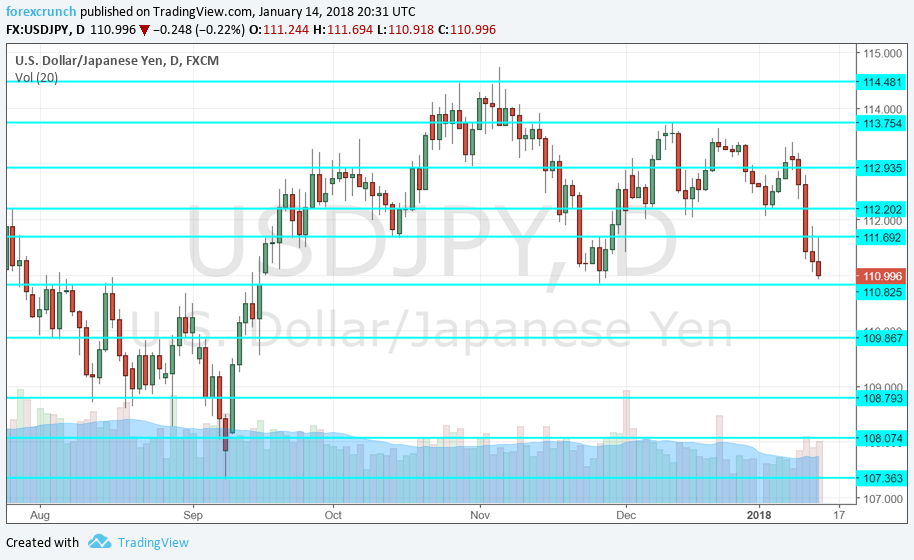

114.50 is the cycle high last seen in early July. The pair got close to that level. 113.70 was a separator of ranges in June and a line of resistance in December. It caps the range.

112.90 served as support in December and is a pivotal line in the range. 112.20 used to be important in the past.

It is closely followed by 111.70, which provided support back in October. The round level of 111 worked as a cushion to the pair in November.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance. Even lower, we find 107.10 as the ultimate level.

USD/JPY Daily Chart

USD/JPY Sentiment

I remain bearish on USD/JPY

The BOJ opened the bottle and the genie is out. But perhaps more importantly, expectations for the Fed’s tightening remain depressed. Will we see a break of 110? If the dollar cannot rally on good news, the way down seems open.

Our latest podcast is titled Oil on a roll and some bitcoin bashing

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!