- USD/JPY is testing critical daily resistance on a firmer greenback.

- Bulls are on the approach to a deeper test, but a correction could be imminent ahead of key US data.

USD/JPY is a touch higher on a firmer US dollar on Wednesday taking the yen through 109.

The pair is 0.35% higher following a rally from a low of 108.72 that has reached a high of 109.14 so far.

After two straight down days, the dollar has finally moved higher against major currencies this week helped along by firmer US yields.

The dollar index DXY was up 0.42% by mid-Wednesday New York session at 90.04, hardening its corrective bias near January lows after a steady slide from the end of March.

Benchmark yields on 10-year US Treasuries are also firming within the range 1.550% / 1.5810% range of the day advancing 1.20% higher to 1.5770%.

The dollar is getting some modest traction with the yen likely to underperform as Japan’s economic outlook worsens, analysts at Brown Brothers Harriman have argued, noting that Japan cut its economic assessment for the first time in three months.

” This shouldn’t come as too much of a surprise after the government extended its third state of emergency for much of the country,” the analysts explained.

”We think there are growing risks that the economy contracts in Q2 given the ongoing virus restrictions linked to the state of emergency. As such, we are more confident than ever that the Suga government will push through another fiscal package over the summer.”

Meanwhile, key US economic data is coming out on Thursday and Friday and the greenback is likely to remain vulnerable until the tide turns in respect of data and rates.

Despite yield firming in recent trade, the 10-year nominal yield had fallen to the lowest since May 7th.

”With 10-year breakeven inflation rates steady at 2.45%, the real U.S. 10-year yield has fallen back to around -0.88% after trading as high as -0.82% last week,” analysts at BBH explained.

”Some are linking the bond rally to month-end factors, but we believe the fundamental story says yields should be higher.”

This makes this Friday’s most important release as an inflation measure watched closely by the US Federal Reserve in April’s core PCE data.

If it is stronger than expected, yields could rise and power the dollar higher.

The market may also get a reality check in May’s Chicago PMI.

”We see upside risks to both readings that will make it hard to justify a 10-year yield near 1.50%,” the BBH analysts forecasted.

USD/JPY technical analysis

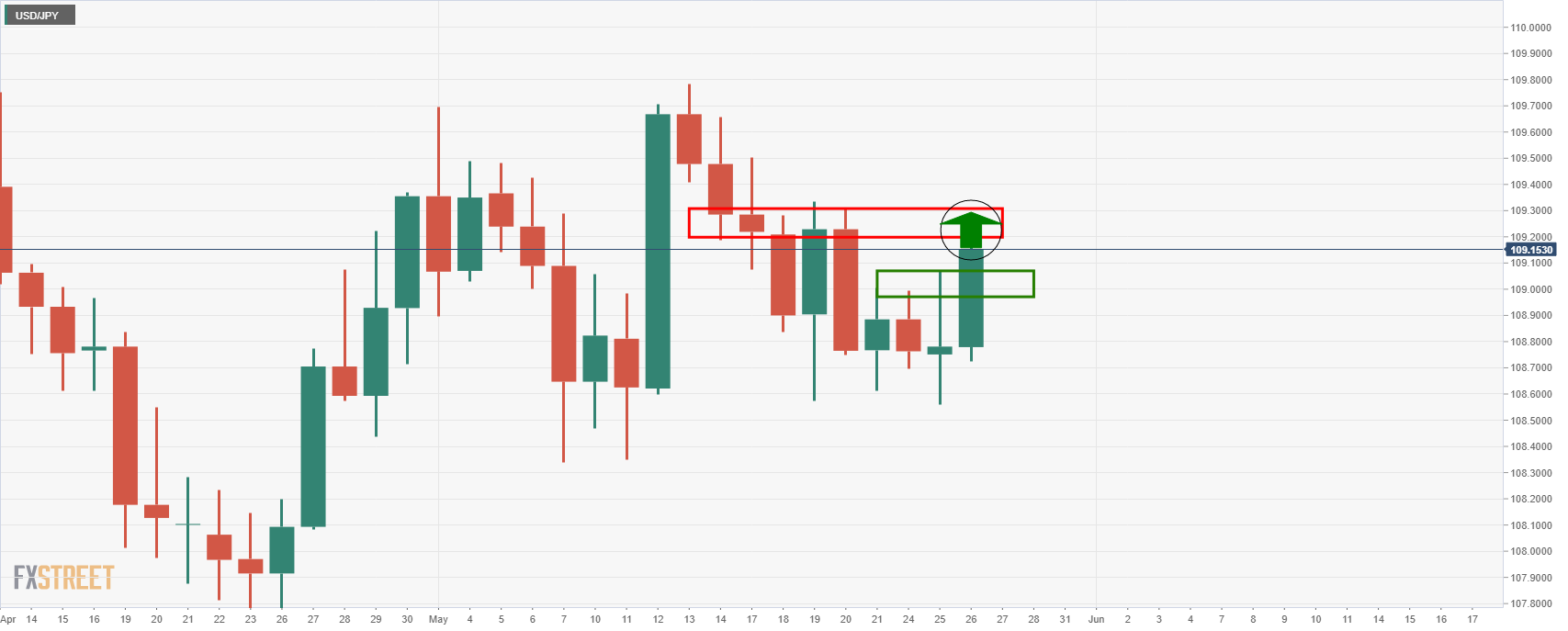

From a daily perspective, there is still room to go to the upside before a firm test of resistance and the supply zone is resolved.

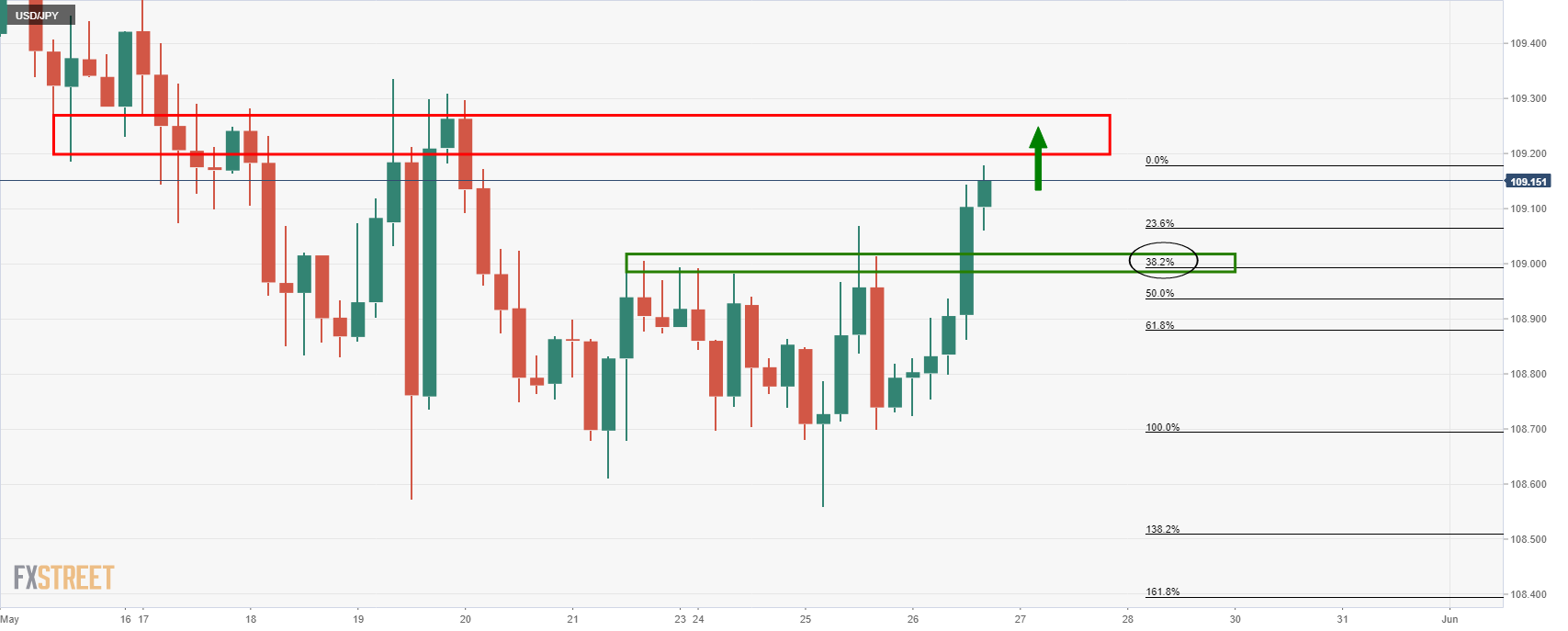

When taking into consideration the Fibonaccis, however, on the 4-hour time frame, there is already a 38.2% Fibo confluence with the prior resistance structure:

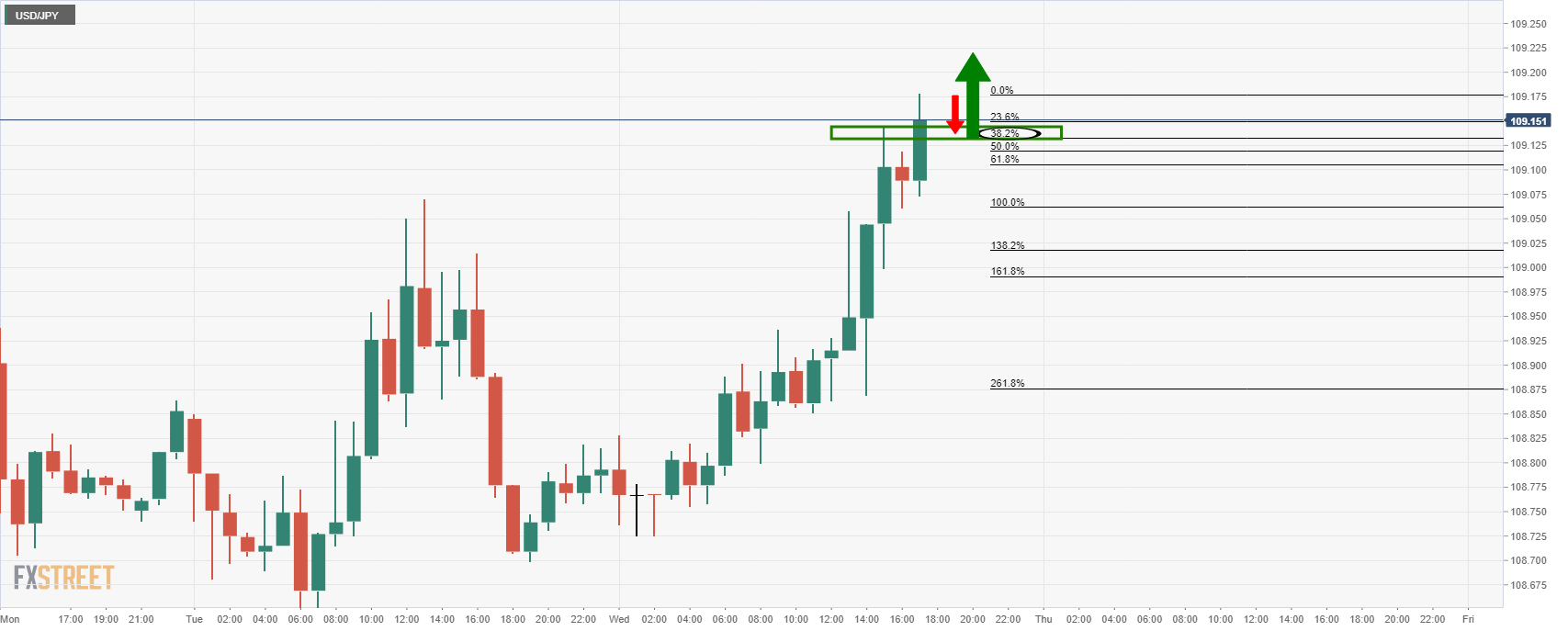

With that being said, if the price does continue higher without a 38.2% pullback, which is feasible from an hourly perspective (see below), then the 50% mean reversion of the 4-hour impulse will align with the old 4-hour resistance instead.