- USD/JPY is in the hands of progress in the US and European politics.

- The US dollar is dependent on the market’s risk apatite, pausing in this week’s advance.

USD/JPY is trading at 104.25 and between a high of 104.57 and a low of 104.13. The pair is being dominated by the ebbs and flows in demand for the greenback pertaining to risk sentiment.

Earlier this week, the US dollar had been enjoying some brief time correcting the dominant downtrend due to souring risk appetite and a downside correction on equities.

However, the greenback is back under pressure and New York traders, typically, are reversing the European session’s USD/JPY bid back below the Asian session’s consolidation.

ECB has an eye on the euro’s strength

The main driver for Thursday’s business has been through the euro.

The single currency climbed on as the European Central Bank (ECB) increased the overall size of its PEPP stimulus program by 500 billion euros ($605.7 bln) to 1.85 trillion euros ($2.2 trillion).

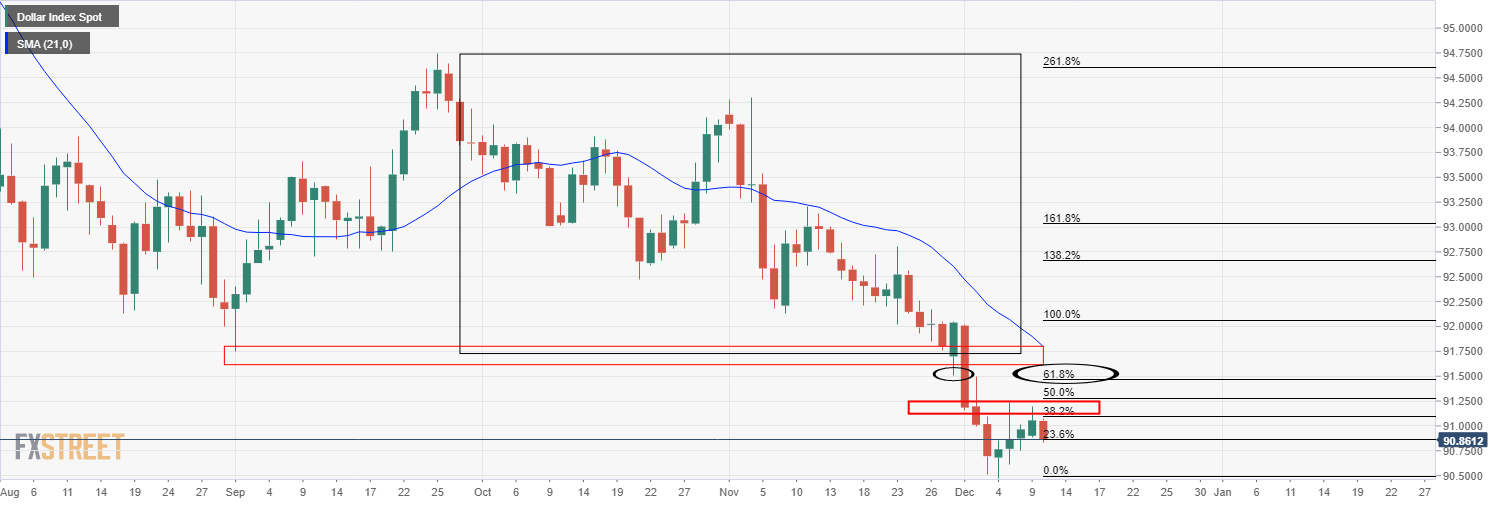

While this was in line with market expectations, it has clearly disappointed some investors hoping for a bigger stimulus boost. In turn, this has seen the DXY pause at a 38.2% Fibonacci retracement level in its pursuit of a 61.8% Fib retracement of the last bearish impulse.

Something that will likely prevent the euro from extending much higher, however, is with the ECB confirming that it is indeed monitoring the euro’s exchange rate.

The ECB made clear that the strength of the euro has implications for the medium-term inflation outlook.

Meanwhile, on Wall Street, the S&P 500 is little changed in late mid-day trade, with focus on US stimulus negotiations and an increase in weekly US jobless claims pointing to a stalling labour market recovery.

The three main indexes opened lower after Labor Department data showed a higher-than-expected rise in weekly unemployment claims.

However, it should be no surprise that the trend will be a little higher, at least in the weeks ahead, consistent with new COVID restrictions taking a toll on the labour market.

The implications, therefore, is for December’s employment report to be even weaker than last week’s report for November.

This all boils down to more pressure on policymakers to come up with another rescue package, as most of the financial aid from the government has dried up.

This makes for the forthcoming Federal Reserve meeting to be a major event in the remaining weeks of the year,

With the being said, US lawmakers have approved a stopgap government funding bill this week that would provide more time for negotiations.

However, an agreement remains elusive due to disagreements over aid to state and local governments and business liability protections but is expected to be finished before the New Year.

COVID in focus

Meanwhile, in the US, new cases are rising again, following the ‘false peak’ after Thanksgiving.

”As in Europe, we are concerned about what will happen over Christmas, not least because many hospitals are running at capacity already,” analysts at Danske Bank explained. ”As we have argued for some time, more and more states are tightening restrictions and more are likely to follow suit. Thus, we expect the economy to face renewed headwinds over the coming months.”

On a more optimistic note, however, the US Food & Drug Administration’s advisory board is meeting today to discuss the Pfizer vaccine and distribution of the vaccine in the US is expected within a couple of days.

The immediate focus now shifts to today’s EC summit and ongoing Brexit risks which have so far not resulted in a deal.

Brexit saga continues

Risk sentiment was dented late on Wednesday, after a dinner between UK Prime Minister Boris Johnson and European Commission President Ursula von der Leyen ended with both sides still “far apart”.

The EU needs to make significant concessions to break the deadlock by the end of the weekend Britain’s sources have said.

We are now focused on Sunday as a possible deadline by which progress may be made.

USD/JPY technical analysis

The pair has played out in a typical reversal of London’s breakout, capped in an M formation and has moved back into consolidation within the Asian session’s ranges.

There is a bias on the hourly charts to the downside in an extension of the latest bearish impulse with a naked Dec 7th session volume profile POC (point of control) located at 104.05.

-637432209571184342.png)