- USD/JPY plummets to weekly lows near 108.30.

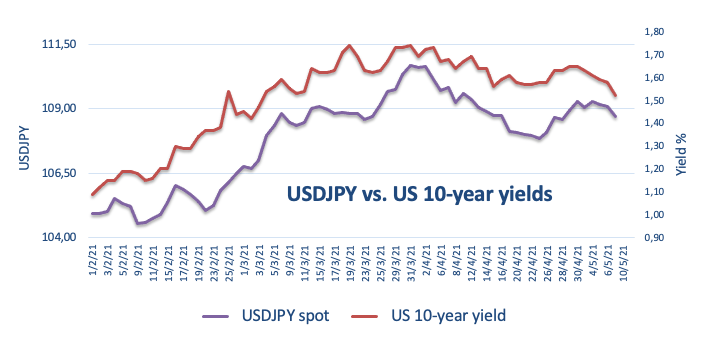

- The leg lower was accompanied by the drop in US yields.

- US Nonfarm Payrolls disappointed expectations in April.

Following a sharp sell-off to the 108.30 region, USD/JPY manages to regain some composure to the 108.70 area, as investors continue to digest the ugly April Payrolls.

USD/JPY weaker on downbeat NFP

USD/JPY now recedes for the third session in a row in response to the strong retracement in the dollar and the deep pullback in US yields in the wake of the April’s US Payrolls.

Indeed, spot briefly tested weekly lows near 108.30 after US NFP surprised to the downside in April, showing the economy added 266K jobs (vs. 978K exp.) and the jobless rate move higher to 6.1% (from 6.05).

The poor prints from the labour market report poured (very) cold water over the potential overheating of the economy narrative as well as prospects of higher inflation in the months ahead. That said, yields of the US 10-year benchmark plummeted to the sub-1.50% region soon after the release, levels last seen in early March.

USD/JPY levels to consider

As of writing the pair is losing 0.32% at 108.73 and faces the next support at 108.33 (weekly/monthly low May 7) seconded by 107.47 (monthly low Apr.23) and then 106.59 (100-day SMA). On the upside, a surpass of 109.69 (weekly/monthly peak May 3) would aim to 110.96 (2021 high Mar.31) and finally 111.71 (monthly high Mar.24 2020).