- USD/JPY is seeing subdued trade just under the 109.00 level ahead of key events later in the week.

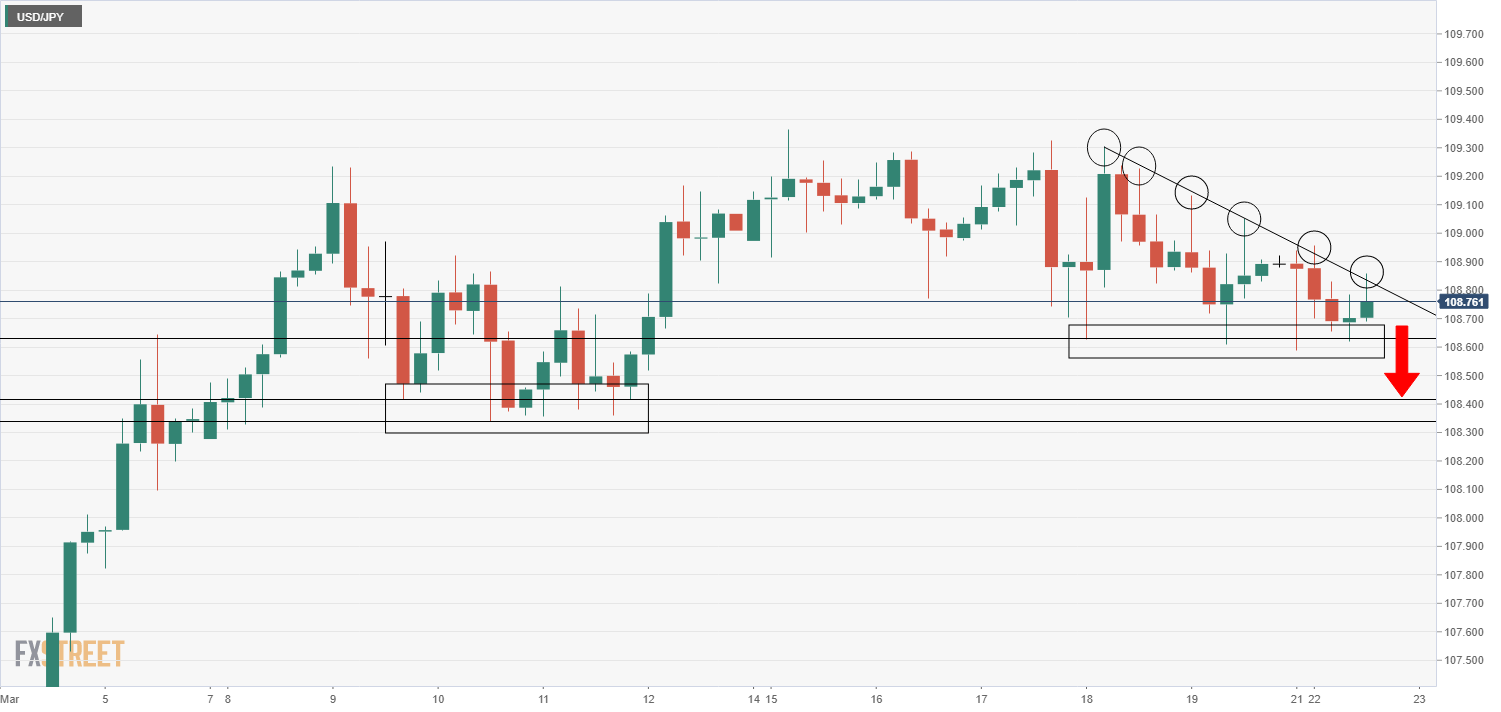

- Technically speaking, the pair is consolidating within a descending triangle which could be subject to a bearish breakout.

It’s been a subdued start to the week for USD/JPY, which has picked up where it left off with things last Friday to continues to range between the 108.60s and 109.00 level. A lack of fresh fundamental catalysts to note over the weekend (US/China talks appear to have come to nothing as expected) mean that uninspired price action is not really very surprising. Moreover, FX markets await a number of key fundamental catalysts later in the week.

Technical Observations

Amid the subdued trading conditions, it appears as though USD/JPY has consolidated within a descending triangle pattern. Typically, these break to the downside. The hypotenuse of the triangle is a downtrend linking the ever-lower highs since 18 March. The bottom of the triangle is Monday and the end of last week’s lows around the 108.60 mark. A break below this area would open the door to a move towards support in the form of the 9, 10 and 11 March lows around 108.40. Alternatively, a break above the hypotenuse would open the door to a run at recent highs back above 109.00 and in the 109.30 area.

Driving the coming week

Three factors are worth watching this week for USD/JPY;

1) Fed speak – Fed Chair Jerome Powell is speaking three times and other key Fed members are also on deck; expect Fed members to stick to the Fed’s usual dovish script, something which (as was the case last week), could present some impediment to the US dollar.

2) US economic data – Preliminary March Markit PMIs are out on Friday and will offer timely insight into the state of the US economy this month and investors will expect a strong survey after regional March Fed surveys last week broadly beat expectations. Core PCE inflation (the Fed’s favoured gauge of inflation) is out on Friday and will be closely watched as ever.

3) US government bond yields – The recent run higher in US government bond yields has been bullish for USD/JPY as it has significantly widened US/Japan rate differentials. If the run higher continues this week, this ought to support the pair.

USD/JPY four-hour chart