- Trade fears continue to knock market sentiment back, and recoveries are being limited.

- This week brings inflation figures for JPY later on, but the early week is a quiet showing.

The USD/JPY is slipping lower heading into Monday’s European market window, with the pair declining towards 109.00 as soured market sentiment weighs on the US Dollar against the Yen, which is receiving a minor boost from Japanese data from late in the Asia session.

Japan’s Leading Economic Index for April came in above expectations, printing at 106.2 versus the 105.1 forecast, while the previous reading was revised lower to 104.5. Japan’s Coincident Index also chipped over expectations, coming in at 117.5 versus the 115.7 forecast, with the previous reading likewise getting revised down to 116.

The US is looking to further clamp down on Chinese investment in US technology firms, and US President Trump is actively seeking to accelerate an direct trade altercation between the two countries. Market sentiment continues to be hobbled by the potential trade-war between the US and China, bolstering the Yen as traders flock into the safe haven JPY.

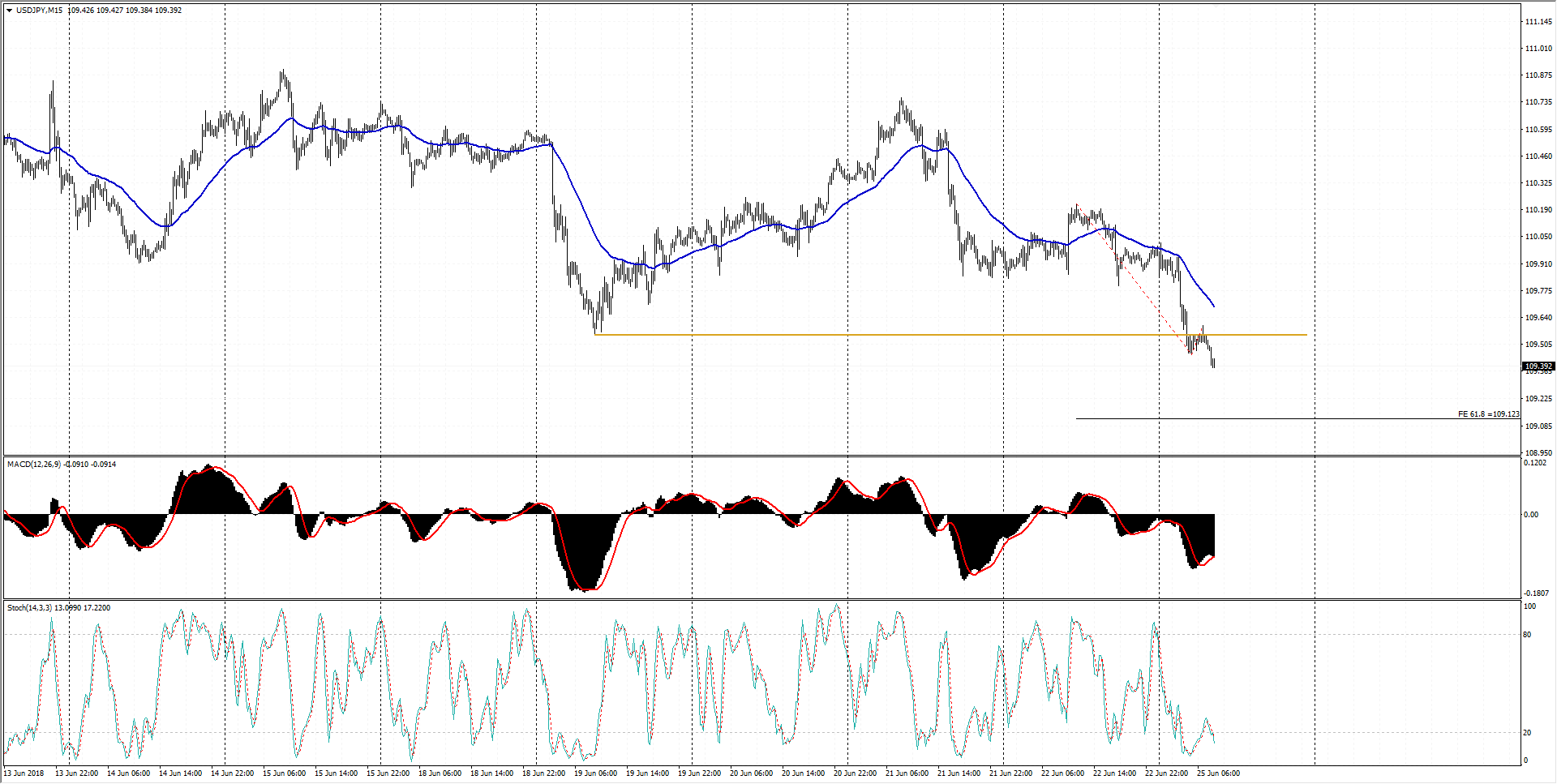

USD/JPY Technical Analysis

Hourly indicators are spinning into oversold territory, but buying opportunities are looking thin as market sentiment shifts under the weight of weekend developments in the ongoing US-China trade spat, and the Yen continues to strengthen as broader markets favor safe havens amidst market uncertainty.

USD/JPY Chart, 15-Minute

| Spot rate: | 109.39 |

| Relative change: | -0.49% |

| High: | 110.02 |

| Low: | 109.38 |

| Trend: | Bearish |

| Support 1: | 109.58 (S2 daily pivot point) |

| Support 2: | 109.12 (6.8% Fibo expansion level) |

| Support 3: | 108.22 (S3 weekly pivot point) |

| Resistance 1: | 109.55 (June 19th swing low; previous resistance) |

| Resistance 2: | 110.02 (current daily high) |

| Resistance 3: | 110.75 (previous week high) |