- The USD/JPY reached the highest in more than a month amid calm on the trade fronts.

- US housing data and the BOJ decision stand out.

- The chart shows a bullish trend after a long period of consolidation.

This was the week: No trade disasters, weak US inflation

The US and China resume negotiations on trade. The initiative came from US Treasury Secretary Steven Mnuchin, and China was quick to respond positively. The US has not implemented the tariffs on $200 billion worth of Chinese goods just yet. However, it is unclear if Mnuchin and his colleagues have the backing of President Donald Trump.

The European Union also made progress on trade talks with the US, while NAFTA talks continue away from the media’s attention.

The better atmosphere pushed the haven yen lower. The yen ignored comments by Japanese Prime Minister Shinzo Abe that said that extremely loose monetary policy will not last forever. A change in the direction of the Bank of Japan may push the yen higher. The BOJ enacts the loosest monetary policy in the developed world.

US data was not that great with inflation missing on all fronts. Core CPI unexpectedly to 2.2%, weighing on the greenback against other currencies but not against the yen. The disappointing number is not expected to change the Fed’s mind about the upcoming rate hike in September.

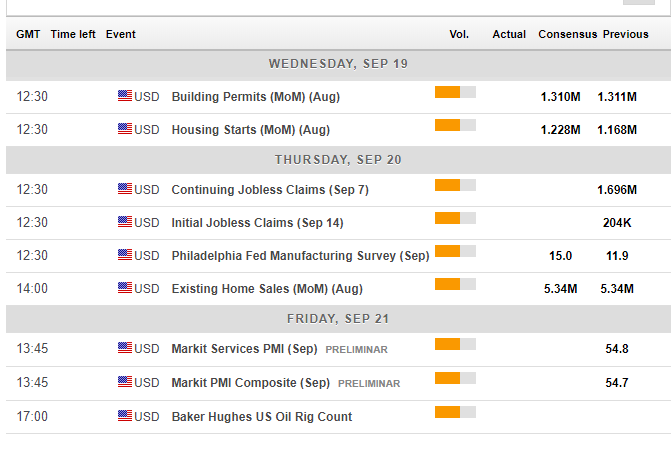

US events: housing figures stand out

After a second busy week in a row, the upcoming one is calmer. Housing Starts and Building Permits are due on Wednesday with a recovery projected in Housing Starts. In many cases, one of the measures misses while the other beats expectations. They would both need to advance in the same direction for us to see a meaningful movement.

Thursday’s Philadelphia Fed Manufacturing Index will be of interest after a substantial fall, but the focus will quickly shift to Existing Home sales. These dropped in the past four months, the worst losing streak since 2013. Markit’s PMI data end the week.

With a relatively light US calendar, there is more space for trade headlines to rock the boat. The trade truce with China, or the dearth of meaningful news, could end. If the US moves forward with imposing new tariffs on China, the market mood could sour.

Here are the top US events as they appear on the forex calendar:

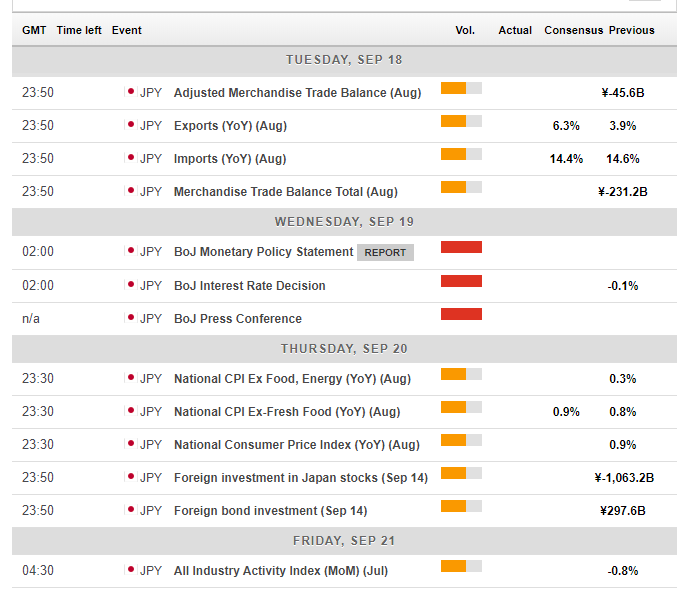

Japan: Moving with stocks

A relatively busy week on the Japanese economic calendar kicks off with trade data before the Bank of Japan makes its decision. The BOJ is projected to maintain the negative 0.1% rate unchanged and continue aiming for a low ten-year yield. Inflation is not going anywhere fast in the Land of the Rising Sun. BOJ Governor Haruhiko Kuroda will hold a press conference on Wednesday to explain the situation and reiterate his pledge to reach the 2% core inflation target.

Inflation data on the national level is due on Thursday and will likely remain at depressed levels. It is important to note that the Tokyo CPI numbers for August are already out.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

The USDJPY broke above the downtrend resistance line that capped it since early August. The Relative Strength Index on the daily chart reached is on the rise but far from overbought conditions. Momentum is on the rise and the pair finally made a convincing conquer of the 50-day Simple Moving Average. All in all, the bias becomes bullish.

111.85 capped the pair in late August and is a battle line. 112.15 was the peak in early August. Further above, 112.65 was a resistance line for the pair on the way and on the way down in July. 113.15 was a swing high in July and towers above the pair.

111.45 held the USD/JPY down and is a weak line of support to the downside. 110.70 was a swing low in late August. 110.10 was another swing low in early August. The most significant line is 109.80 which was August’s trough.

USD/JPY Sentiment

The FXStreet forex poll of experts provides intriguing insights

-636725094608716175.png)