- US dollar losses strength against yen as Wall Street drops for the second day in a row.

- Greenback is about to end the week unchanged despite higher US yields.

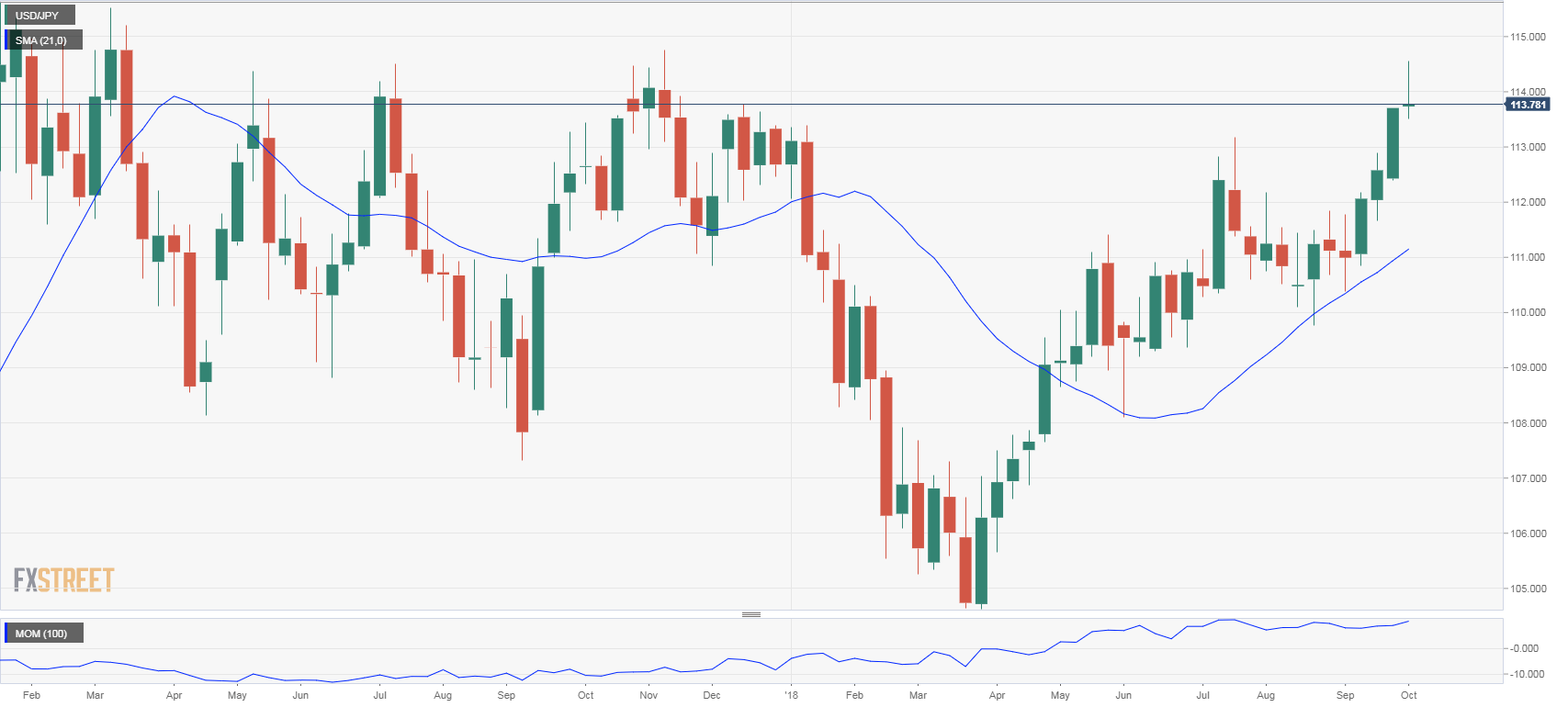

- USD/JPY technical outlook: bullish trend but negative signals emerge.

The USD/JPY pair spiked to 114.05 after the release of the US employment report but quickly resumed the downside. During the US session bottomed at 113.55, the lowest level in two days. Then bounced to the upside, and it was about to end the week hovering around 113.75/80.

The employment report showed lower-than-expected payroll growth in September offset by a positive revision to previous months and the decline of the unemployment rate to the lowest in 48 years. “As well, there were cumulative upward revisions to hiring the two previous months of 87k that more than offset the miss on the September gain. Indications of a falling unemployment rate and rising wage pressures are expected to keep the Fed tightening. Our forecast assumes the fed funds range will rise another 25 basis points in the final quarter of this year with similar-sized increases occurring every quarter through 2019. This is expected to result in the upper end of this range finishing next year at 3.50%”, wrote RBC analysts.

Between yields and risk aversion

The USD/JPY rose sharply on Wednesday and peaked around the 114.50 area, the highest since November of last year. The move higher took place at the same time the Dow Jones hit new record highs and as US yields climbed to the highest in years.

Those two factors pushed USD/JPY sharply higher. But that same day, USD/JPY started to lose strength. Today, the 10-year yield printed a new multi-year high at 3.24%, but the US dollar dropped versus the yen. The key factor was the drop in equity prices. The Dow Jones was falling 0.90% on Friday and from the weekly top, was down more than 500 points. The implication of higher yields was offset by a negative sentiment toward equities.

USD/JPY weekly chart shows…

The pair is about to end the week flat and far from the highs. The formations send mix signals regarding the future. The weekly chart could be a concern for the bulls. If the greenback manages to rise back above 114.00 it could recover the initiative, in line with the main trend that still points to the upside but not as decisive as two days ago.