- USD/JPY has rallied to print fresh highs on Asia as the dollar firms.

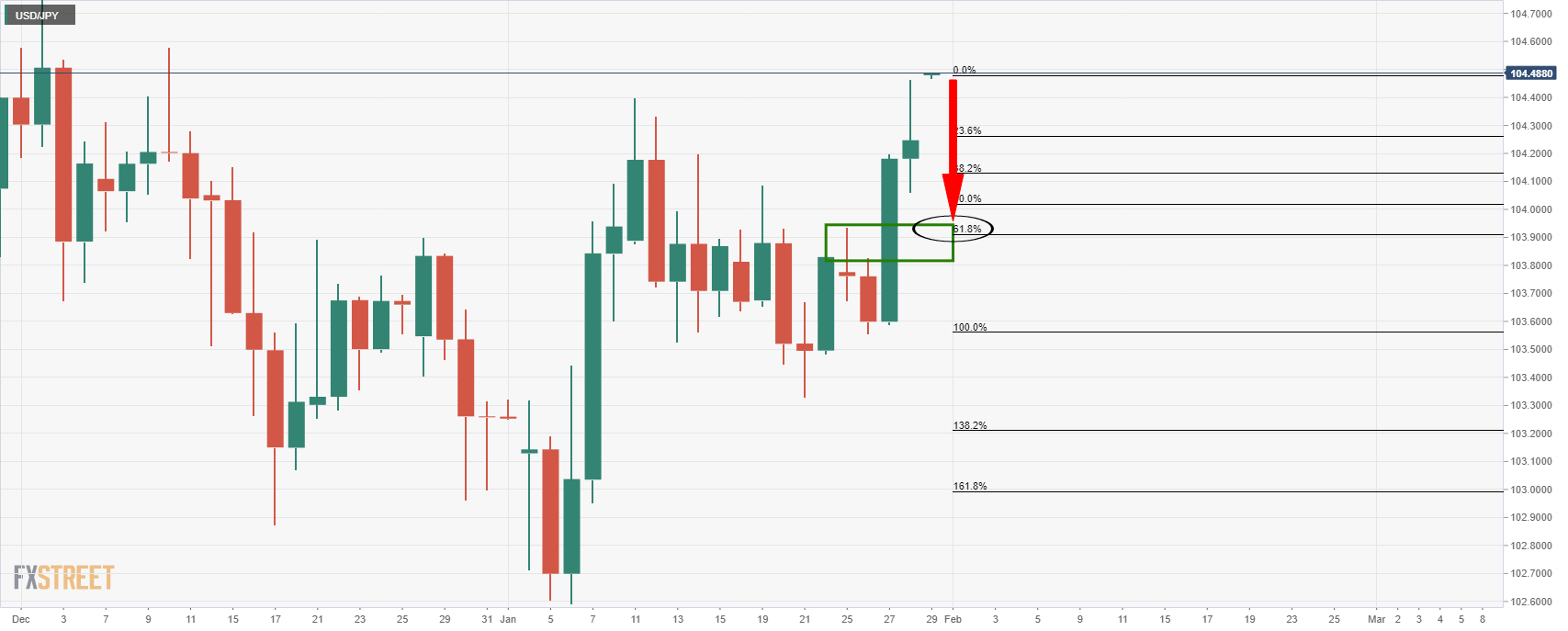

- The daily perspective is somewhat more bearish as a 61.8% Fib aligns with structure.

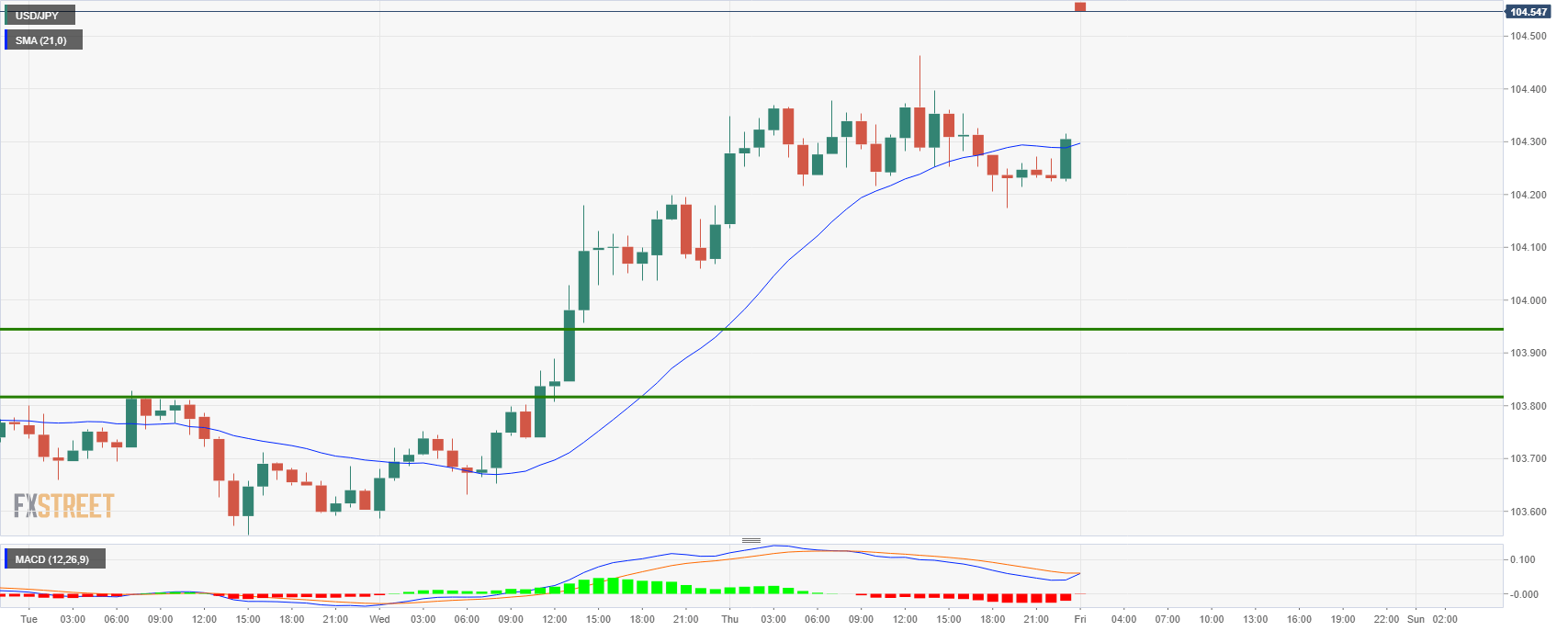

USD/JPY is trading on the bid to score fresh highs within the recent breakout from the long-term downtrend.

At the time of writing, the pair is trading at 104.48 between a range of 104.17 and 104.49 up some 0.28%.

The dollar stabilising following a weaker performance on Thursday with risk appetite improving overnight.

Data showed that US jobless claims fell in the latest week, while dire Gross Domestic Product data met expectations contracting at its sharpest pace since World War Two in 2020.

The Labor Department said separately that initial claims for state unemployment benefits totalled a seasonally adjusted 847,000 for the week ended Jan. 23. That was down 67,000 from the prior week.

Claims ate holding above their 665,000 peak during the 2007-09 Great Recession.

Meanwhile, there has been a keen major focus on stock markets with stockbrokers such as Robinhood Markets and Interactive Brokers curbing the trading in stocks recently affected by large-scale short squeezes.

Robinhood stopped facilitating new options positions in GameStop, AMC, and BlackBerry, among others.

Gamestop (GME) Stock News: GME share price consolidates after huge volatility, what’s next?

In recent trade, Japan released a series of data that included Industrial Production, the Unemployment Rate and the Tokyo Consumer Price Index, all of which beat expectations but failed to support the yen.

”The Bank of Japan also provided the Summary of Opinions in the projections for inflation and economic growth.

Japan’s economy has picked up as a trend, although it has remained in a severe situation due to the impact of the novel coronavirus (COVID-19) at home and abroad,” the summary stated.

USD/JPY technical analysis

The price has begun to show signs of weakness in the bullish impulse and the W-formation’s neckline is expected to offer support as a downside target with a confluence of the 61.8% Fibonacci retracement.

With that being said, the price is trading in firmly bullish short term technicals still.