- USD on the back foot on US CPI miss ahead of Fed’s Powell.

- USD/JPY bulls step up at a critical support structure.

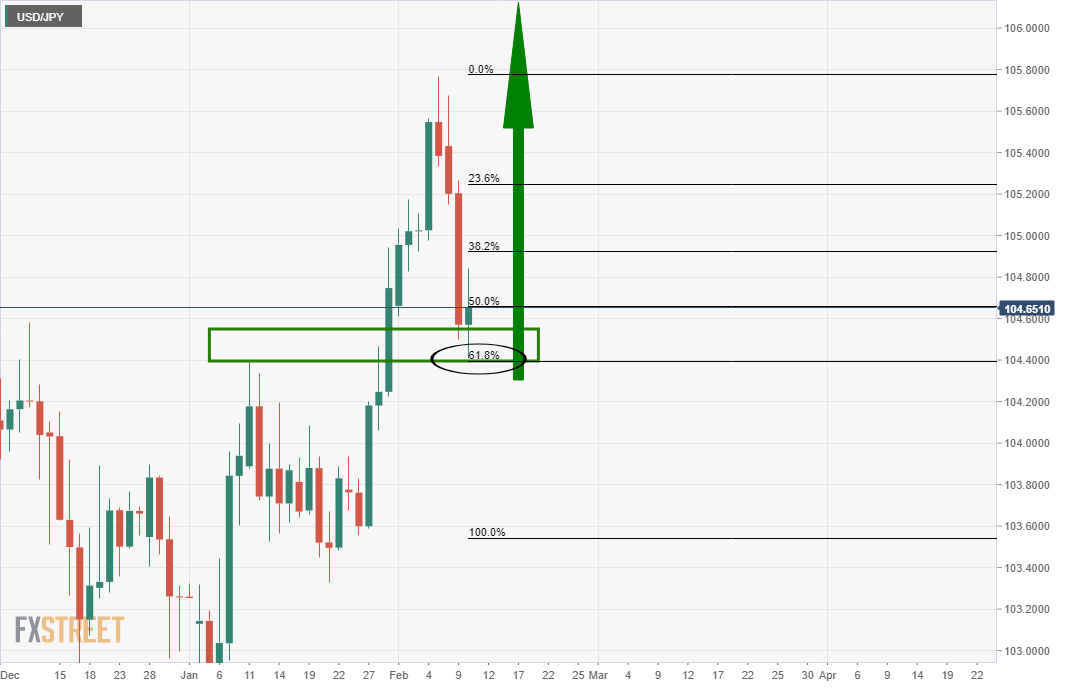

USD/JPY is trading at 104.64 at the time of writing in between a range of 104.40 and 104.84 for the day so far, firing despite the meltdown in the US dollar.

The miss on US CPI, 1.4% vs 1.5%, provided another blow for USD bulls with the DXY now trading below its 50DMA while the US 10-year yield tests its 10DMA trading down over 1.6%.

The yen continues to show that it’s more yield-sensitive than risk-sensitive with the pair moving back from the 200DMA average near 105.55.

The Bank of Japan is now stepping in with increased rhetoric regarding deeper negative rates, jawboning the currency by saying that it may seek to clarify in the March policy review that it has room to deepen negative interest rates.

Meanwhile, the Federal Reserve will not update its projections until the March 17 meeting, but Jerome Powell, the Fed’s chairman, will be speaking today at the Economic Forum where the need for fiscal support will be on his agenda.

USD/JPY technical analysis

The price has fallen to test prior structure in a 61.8% Fibonacci retracement which would be expected to now act as support.