Key news updates for USD/JPY

Updates:

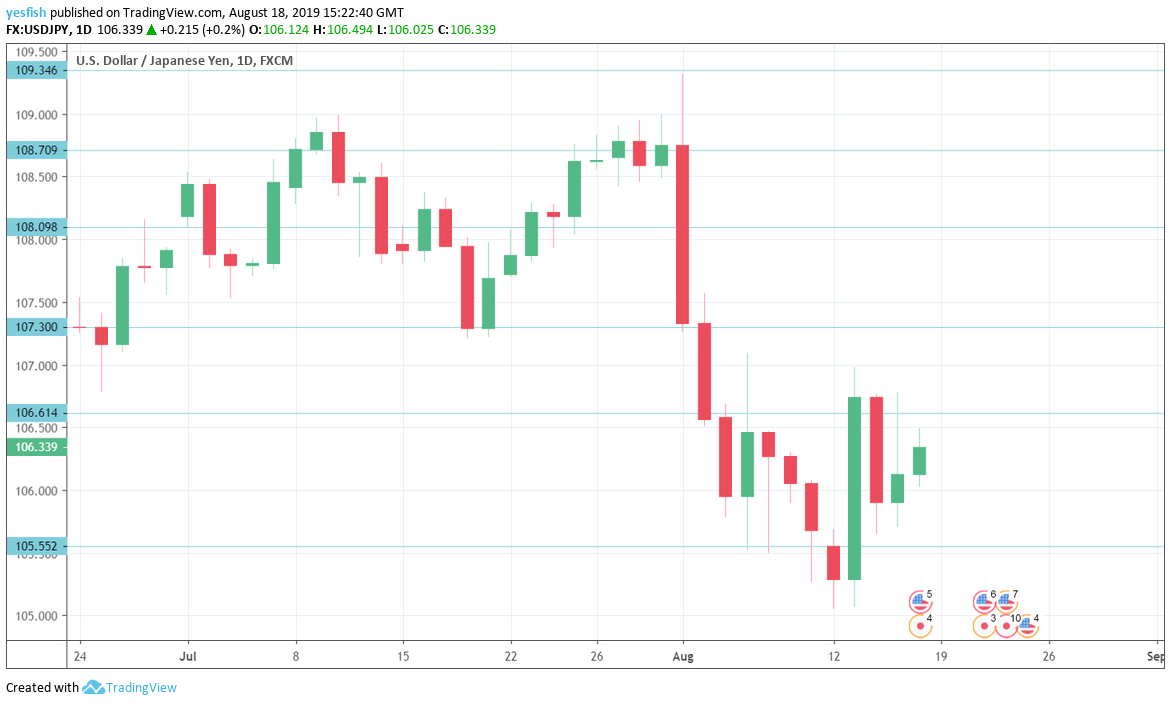

USD/JPY Technical Analysis

We start with 109.73, which has held in resistance since the end of May. 109.35 is close by.

108.70 follows.

108.10 was a swing low in late May.

107.30 has held in resistance since the first week in August.