- Inflation is rising in Japan, from 1.2% to 2.5% after many years of deflation.

- The Bank of Japan governor, Haruhiko Kuroda, remains dovish concerning rate hikes.

- Dollar weakness is expected to push USD/JPY lower.

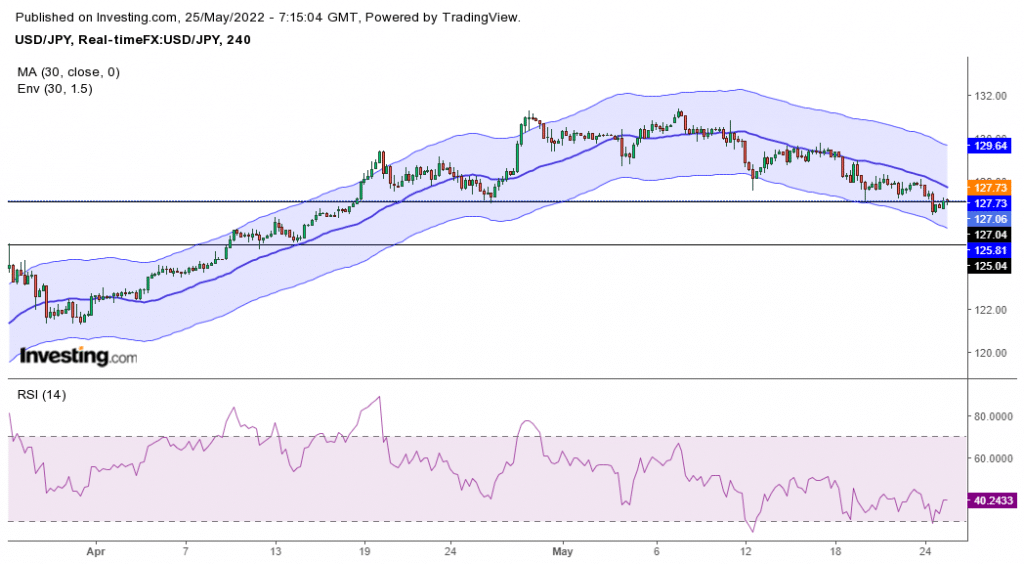

The USD/JPY forecast turned negative as it closed down on Tuesday, showing some strength in the Yen, which hit 20-year lows earlier this month. Recent dollar weakness and a rise in inflation in Japan have seen USD/JPY go lower.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

The YoY inflation rate for Japan went up from a previous value of 1.2% to 2.5%. This rise is a significant change for Japan after years of deflation. But the Bank of Japan didn’t change its policy because other central banks said inflation would go down.

The Bank of Japan governor, Haruhiko Kuroda, maintained his dovish sentiments on Friday, May 20, saying that the recent cost-push inflation will not last. There will therefore be no need for a withdrawal of stimulus. He said they would maintain the yield curve control policy, including negative interest rates. The bank will continue buying bonds to keep 10-year yields at 0%.

On the other hand, Japan has kept its inflation rate low despite price pressures from the rest of the world. Therefore, there is no hurry to raise interest rates, which could keep the Yen down.

If the war in Ukraine keeps pushing energy and food prices higher, then investors will stay with the safe dollar, bringing back dollar strength, and we might see USD/JPY going back up.

USD/JPY key events today

Investors will be paying close attention to the US to see durable goods orders for April. The FOMC meeting minutes are also expected to move the pair.

USD/JPY technical forecast: Backtrack to 125.00

The last time we saw prices at 125.00 was in early April. Since then, the price has gone up to 131.00, where bears took over from bulls. The pair is currently trading below the 30-SMA in a new downtrend.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

RSI is, however, not very convincing as it is barely getting oversold. The Bears are still not showing their strength. It is as if they are waiting for something to convince them to push prices lower. The price is currently trading at 127.00 after closing lower yesterday. The bias here remains down, so we can see the price getting to 125.00.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money