- The USD/JPY pair climbed above 128.20 as the yen continued to weaken.

- James Bullard, the Fed’s governor for this fiscal year, is more hawkish than he was before.

- The national consumer price index in Japan is 1.3%, up from 0.9% in the previous month.

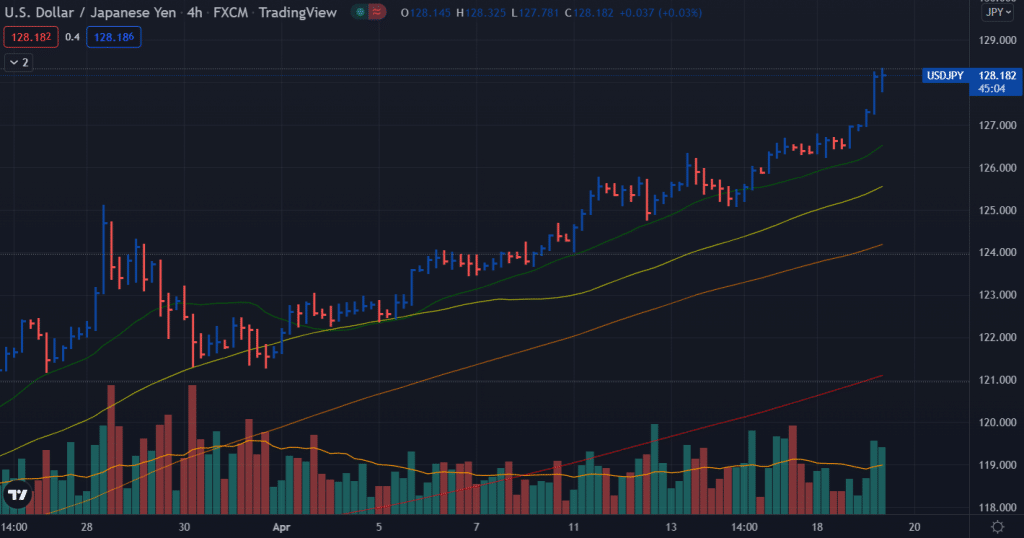

The USD/JPY price forecast remains strongly bullish as the pair is heading beyond two-decade highs, eying 130.00 amid central bank divergence.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

Following the holiday hangover, the USD/JPY pair showed strong bullish movement. In the Asian session, the asset touched an intraday high of 128.23. Different interest rate adjustment schedules between the Federal Reserve System (Fed) and the Bank of Japan (BOJ) strengthen the US dollar against the Japanese yen.

Fed’s hawkishness

Since market participants have begun pricing in aggressive rate hikes and a dovish outlook for the remainder of the year, the dollar has been performing well. James Bullard, head of the Louis Fed, said on Monday that interest rates must increase to 3.5% by the end of the year.

As a result of an aggressive gesture from FOMC member James Bullard, the US Dollar Index (DXY) became unstoppable. The DXY index has surged above 101.00 and is attempting to gain traction above it.

What’s next to watch?

This week’s Consumer Price Index (CPI) will determine the value of the Japanese yen. Japan’s inflation is predicted to be 1.3% rather than 0.9%. As the economy has not yet recovered to pre-Covid-19 levels, the Bank of Japan (BOJ) will opt for a loose monetary policy.

Moving ahead, the investors are looking at Fed Chair Powell, who may provide some clues about the monetary policy action for the next month.

USD/JPY price technical forecast: Bulls looking at 130.00

The USD/JPY price shows a promising uptrend on the 4-hour chart. The key SMAs are lying one above another in a parallel way, indicating strong momentum. The pair may look for another surge towards the 130.00 area.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

The volume for the recent two bars is very high. The up bar was followed by a down bar that may close near the middle range of the bar with a huge volume. This is another indicator of further bullish price action.

However, the bullish rally has not yet seen a correction so far. Hence, we can expect a strong downside correction at any time.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money