Dollar/yen dropped in the first week of December, suffering alongside the stock markets, which lost faith in the talks between China and the US, and also in the direction of the Fed. What’s next? The US data includes inflation and retail sales, but trade talks and stocks will have a significant influence.

USD/JPY fundamental movers

Trade summit, Powell more optimistic, and a mediocre NFP

The week began with a positive note after Presidents Donald Trump and Xi Jinping agreed on a trade truce for 90 days. However, the reports from Beijing did not echo those from Washington and after a rally in shares and in dollar/yen, things turned south. When China finally echoed the American message, came the news of the arrest of Huawei’s CFO and daughter of the founder. This sent equities lower, and the pair followed.

Fed Chair Jerome Powell had a different tune. After his words about interest rates being “just below” the range considered neutral were perceived as dovish, he expressed satisfaction from the economy and especially the labor market. Markets may be skeptical about hikes in 2019, but the FOMC seems on course to continue tightening.

However, the Non-Farm Payrolls report was not that great. The economy gained only 155K positions in November and monthly wage increases stood at only 0.2%. Other figures, such as the annual increase of 3.1% in salaries, was more encouraging.

In Japan, officials continued expressing the need for ultra-loose monetary policy, providing no surprises.

Inflation and retail sales

Powell will not speak for the third week in a row. His testimony was canceled due to the funeral of former President George H. W. Bush. However, we will receive the all-important inflation report on Wednesday. Core CPI disappointed in October with 2.1% and it dragged the Core PCE below 1.8%. The fresh number for November will provide fresh insights.

The retail sales report is also of interest as the US economy is centered around consumption. The report for October was quite upbeat and we will now learn what the American consumer did in November, the month including Black Friday.

In Japan, the calendar includes the final GDP report early in the week and also the Tankan manufacturing surveys on Friday may be of interest. However, the yen continues moving mostly as a safe-haven currency and not by Japanese figures.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

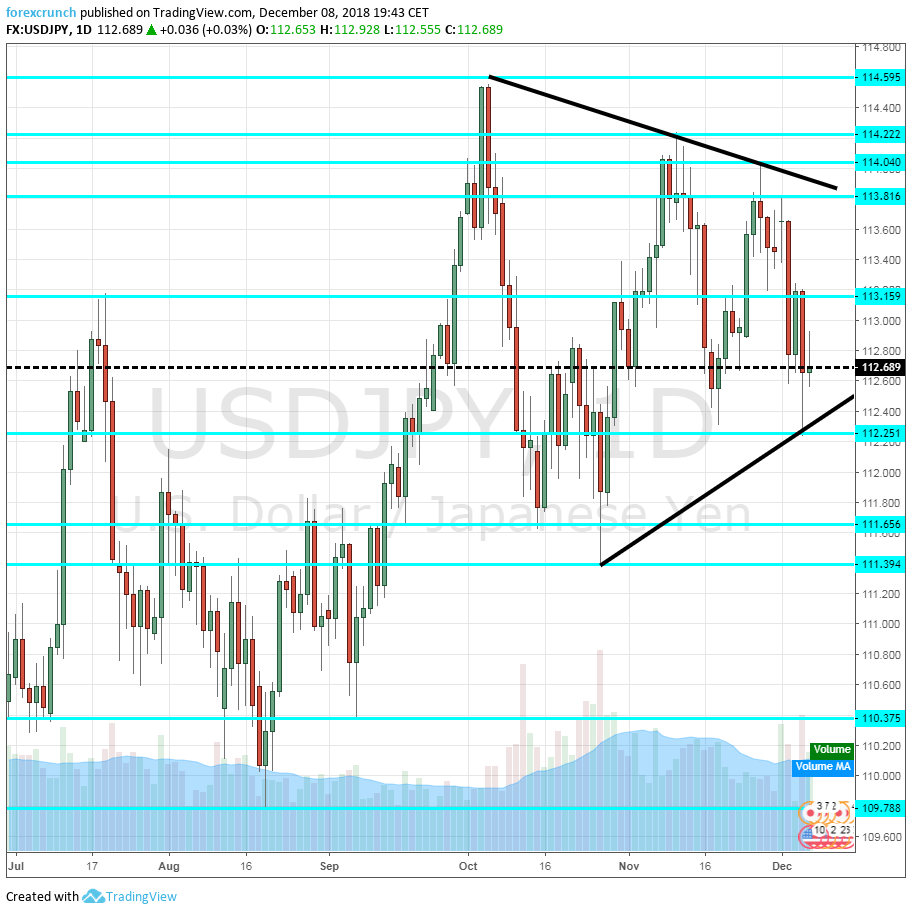

The pair is trading in a narrowing wedge. Downtrend resistance began with the peak in September and was touched twice later on. Uptrend support is more recent, dating back to mid-October.

115.55 was a high point in the first half of 2017 and is an upside target. 114.60 was the high point in early October and serves as resistance. 114.25 was the high point in November.

114 is a round number and was a stepping stone on the way down. 113.80 was a resistance line in November.

113.15 was a swing high back in July. 112.25 provided support in early December and it defends the 112 level.

111.65 was a swing low in October and it is closely followed by another swing low at 111.40 seen later that month.

110.40 provided support in early September and the pair rallied from that point. 109.70 was a swing low in late August and provides extra support below the round 110 level.

Close by, 109.35 was a cushion in mid-July. 108.70 was a cushion early in the summer and 108.10 a swing low in late May.

Lower, we find 107.50 capped the pair in early April and is a strong line.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

The global economy is slowing down and stocks are on the back foot. This is the perfect environment for the yen to shine.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!