- The dollar remained close to a five-week high against major peers.

- The market is more concerned about the upside risks to US inflation than downside risks.

- Kazuo Ueda, a former BOJ board member, will likely take over as governor.

Today’s USD/JPY forecast is bullish. In anticipation of an important consumer price report tomorrow, the dollar remained close to a five-week high against major peers on Monday. There are growing expectations for more Federal Reserve policy tightening.

–Are you interested to learn more about forex options trading? Check our detailed guide-

According to Shinichiro Kadota, senior FX strategist at Barclays in Tokyo, the dollar has been strongly supported since the much-stronger-than-expected US employment data earlier in the month. Fed remarks have also gone more to the hawkish side, but the priority is tomorrow’s CPI.

“the market is more concerned about upside risks to inflation than downside risks.”

Before the CPI release on Tuesday, updates to the previous data set revealed that consumer prices increased in December rather than declining as previously predicted.

Separately, the University of Michigan surveys revealed a one-year inflation outlook of 4.2%, higher than the final figure in January.

The yen declined as the government prepared to name a candidate who supports the present policy framework as the new governor of the Bank of Japan on Tuesday.

On Friday, sources said that Kazuo Ueda, a former BOJ board member, would take over as governor. Ueda is regarded as an expert on monetary policy but wasn’t even considered a serious contender for the top position. Markets were therefore caught by surprise.

In an interview the next day, he stated that the BOJ should continue to follow its ultra-easy policy.

USD/JPY key events today

No key economic releases from Japan or the United States are scheduled today. The pair will likely consolidate as investors await the US inflation report.

USD/JPY technical forecast: Bulls win the battle at the 30-SMA

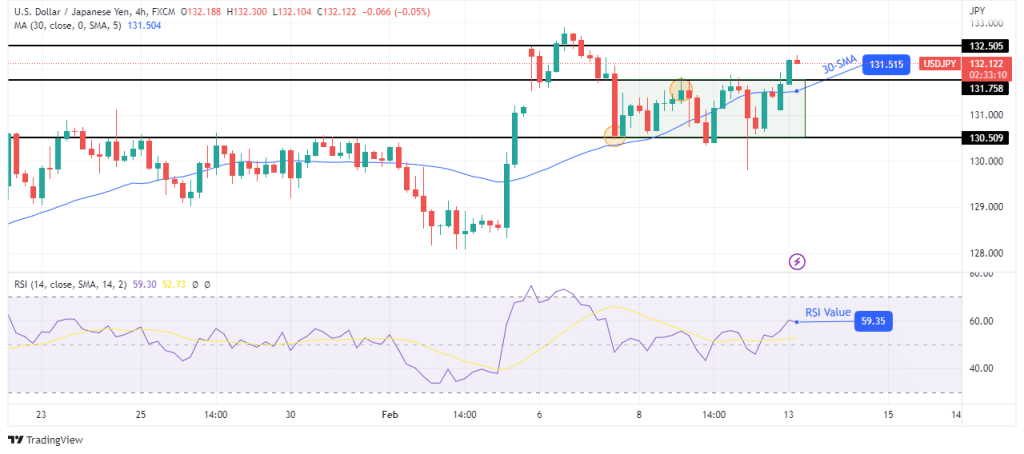

The 4-hour chart shows USD/JPY trading above the 30-SMA with the RSI above 50, pointing to a bullish move. This follows a breakout from a range with the support at 130.50 and the resistance at 131.75.

–Are you interested to learn about forex robots? Check our detailed guide-

There had initially been a false breakout to the downside. Although bears managed to push the price below the range support, they could not close below. This allowed bulls to take over and push the price out of the range area. The next target for bulls is at 132.50 resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.