- Markets are pricing an 86% chance that the Fed will lift rates by 25 basis points.

- Major Japanese manufacturers remained pessimistic in April.

- The outlook for Japan’s service sector improved for a second consecutive month.

Today’s USD/JPY forecast is bullish. The dollar rose as investors focused on the Federal Reserve’s probable steps to control inflation.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

The US dollar selling stalls as markets are pricing an 86% chance that the Fed will lift rates by 25 basis points (bps) at the May meeting. Investors are reversing expectations of cuts later in the year.

According to the monthly Reuters Tankan survey released on Wednesday, major Japanese manufacturers remained pessimistic for a fourth consecutive month in April. Concerns over Western banks added to the slowing global growth. This lowered hopes for an export-driven rebound.

Nevertheless, it also revealed that the outlook for the service sector had improved for a second consecutive month and had reached a four-month high. It indicates a post-COVID economic rebound driven by inbound tourism, which has benefited restaurants and stores.

The survey findings were consistent with the BOJ tankan, released on April 3, and showed that the big manufacturers’ sentiment index declined for a fifth consecutive quarter. This was due to rising costs for energy, raw materials, and mixed feed. The mood in the service sector slightly improved due to the loosening of COVID curbs.

Kazuo Ueda, governor of the BOJ, has promised to keep monetary easing in place for the time being to assist a fragile economy. When Ueda heads his first policy-setting meeting on April 27-28, the tankan surveys will be one of the indicators closely examined to assess business strength.

USD/JPY key events today

Investors will focus on Fed rate hike expectations as there won’t be any key economic releases from the US or Japan.

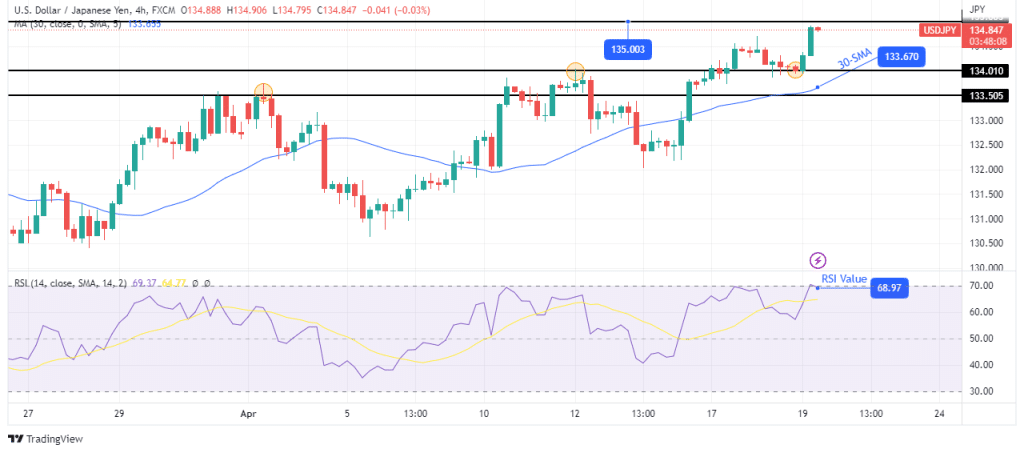

USD/JPY technical forecast: Bullish bias strengthens with new highs

USD/JPY is quickly climbing and might soon break above the 135.00 resistance level. The bias here is firmly bullish as the price is far above the 30-SMA and the RSI near the overbought region. The price has also made higher highs and higher lows after breaking above the 134.01 resistance.

–Are you interested to learn more about South African forex brokers? Check our detailed guide-

After such a strong bullish move, we might get a pullback before the uptrend continues. However, bulls will keep control if the price stays above the 30-SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.