- The pair hit highs last seen in 1998.

- The bull rally is set to continue as long as the monetary divergence between Japan and US is in place.

- Inflationary pressures are arising from the Yen’s decline.

Today’s USD/JPY forecast is bullish. As the United States tightened its monetary policy faster and increased the gap with Japan’s stubbornly low interest rates, the dollar reached a new 24-year high against the rate-sensitive Japanese yen.

–Are you interested in learning more about forex signals? Check our detailed guide-

The Yen hit its lowest point since 1998 at 140.97 and last traded at 140.91 per dollar.

“After we saw the break of 140 … the momentum was skewed for yen weakness,” said Galvin Chia, an emerging markets strategist at NatWest Markets.

“So long as (yield curve control) is in play, and so long as interest rate divergence is in place, one of those side effects would be a weaker yen.”

The Yen is sensitive to increases in yields overseas because the Bank of Japan is intervening in the markets to keep government bond yields in check.

The benchmark 10-year yield in the US recently stood at 3.2576%, up from its finish on Friday of 3.191%. Despite a rise in COVID-19 cases, household expenditure in Japan increased for a second consecutive month in July. However, inflationary pressures brought on by the Yen’s decline to a 24-year low have raised doubts about a recovery in consumption.

This week’s figures have seen private consumption slowing, weakening some of the gains made in April-June due to declining real earnings and service sector activity.

“Rising prices without wage growth can be an obstacle to the private consumption recovery in the next six months,” said Takumi Tsunoda, senior economist at Shinkin Central Bank Research Institute.

USD/JPY key events today

The Institute of Supply Management (ISM) Non-Manufacturing Purchasing Managers’ Index (PMI) report from the US is expected to drop from 56.7 to 55.1.

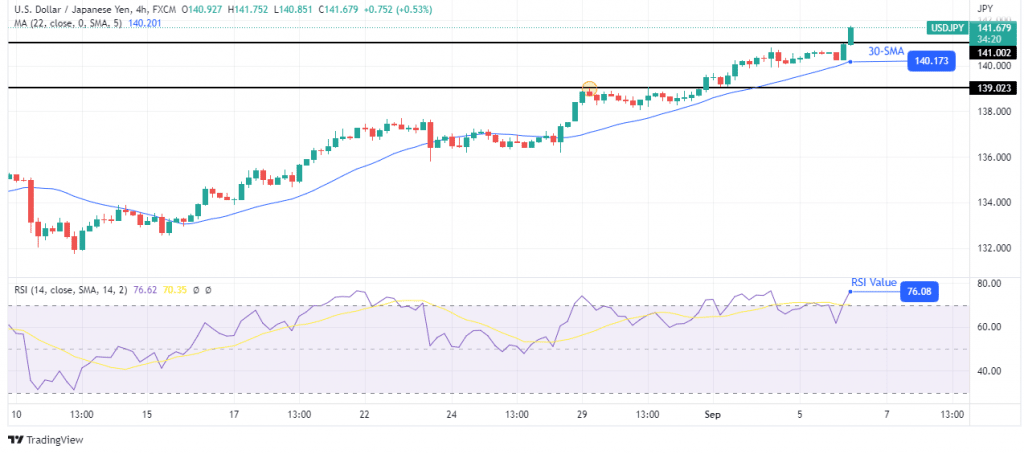

USD/JPY technical forecast: Bulls dominate in the overbought region

Looking at the 4-hour chart, we see the price trading well above the 30-SMA and RSI in the overbought region. A distinguishing characteristic of strong bullish trends is RSI readings above 70. It shows bulls are strong enough to push the price to extreme levels.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

The price has broken above 141.002, a psychological level. It will most likely hit the next psychological level before retesting 141.002.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.