Dollar/yen wobbled and eventually remained unchanged in a light week but it now faces much more important events. The Kim-Trump Summit is the key geopolitical event, and it is followed by the Fed decision, the BOJ decision and more.

USD/JPY fundamental movers

Ignoring trade wars

After the Italian story came to an end, for markets, the trade wars between the US and all the rest grabbed attention. The row with Canada was especially nasty. Nevertheless, the safe-haven Japanese yen did not garner significant demand.

Apart from that, the US ISM Non-Manufacturing PMI came out above expectations and so did most other economic indicators.

Historic Summit, Fed, BOJ, and key data

The word “historic” is undoubtedly appropriate for the first meeting between a sitting US President and the leader of North Korea. Reaching a deal on a verifiable denuclearization would be quite hard to achieve instantly but progress on the peace process would be a huge improvement after months of tensions around North Korea’s nuclear and missile tests.

Reports about success would send USD/JPY higher on a risk-on sentiment while a failure would send the pair lower on a risk-off atmosphere.

Back to regular events, the US inflation report is expected to show core CPI above 2% and it comes at a critical time ahead of the Fed decision. An acceleration in price development could send the greenback higher. Core CPI stood at 2.1% y/y in April.

The main economic dish is the Fed decision. There is no doubt that Jerome Powell and co. will raise interest rates for the second time this year, but the path forward is unclear. The Fed’s current dot-plot shows only 3 rate hikes in 2018 and markets expect a pause in September. The Fed could leave that unchanged but perhaps drop the wording about “accommodative monetary policy”, a hawkish move.

The busy week continues with the US Retail Sales, a top-tier indicator as always and a critical input for the GDP report.

The Bank of Japan concludes the top-tier events for the week and this will probably be a non-event, similar to previous events. With inflation decelerating in the Land of the Rising Sun, the BOJ will likely maintain its negative interest rate and pledge to keep the 10-year yields at 0%.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

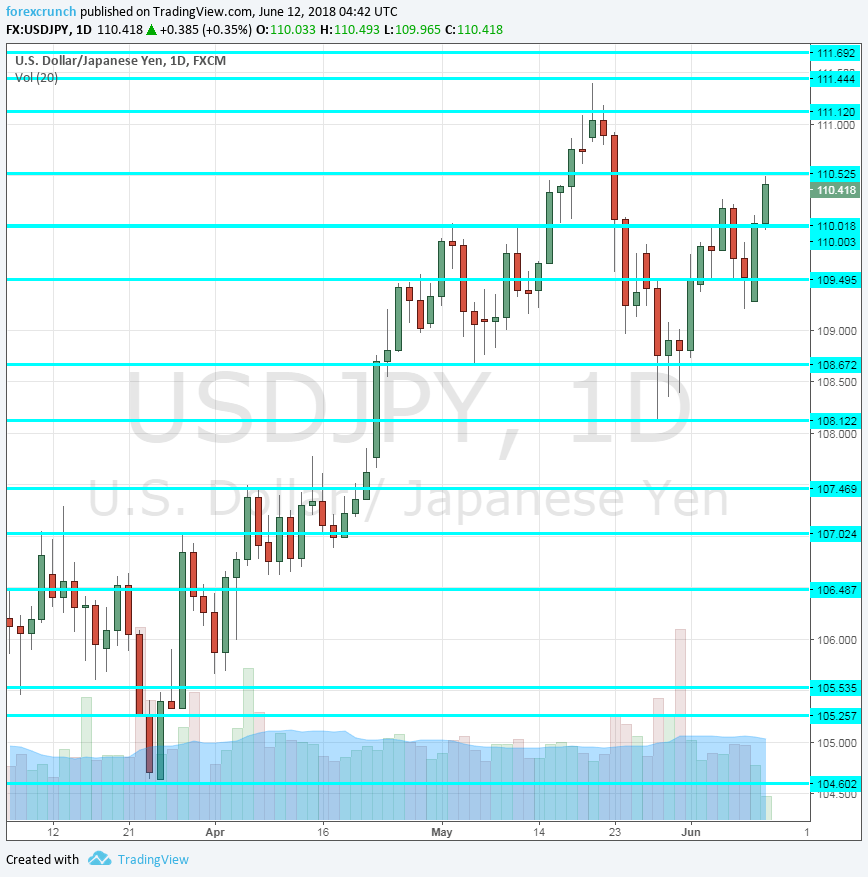

112.20 supported the pair back in December. It is followed by 111.40 which capped the pair in mid-May. 11.10 is another line to watch as a high point.

Further down, 110.50 was a swing high in February. The round number of 110 serves as a psychological level. 109.50 held the pair back in late April.

109 was a pivotal line within the range. 108.70 was a stepping stone on the way up. 108.10 was a low point in late May and serves as a support line.

Lower, we find 107.50 capped the pair in early April and is a strong line.

106.50 was a resistance line in mid-February. and then resistance in early March. 105.55 was the first swing low.

USD/JPY Daily Chart

USD/JPY Sentiment

I am neutral on USD/JPY

While the pair could enjoy smiles coming from Singapore and also on talk of “normalization” from the Fed, trade wars could weigh on the US Dollar, or more precisely, boost the safe-haven Japanese yen. All in all, things could be balanced.

Our latest podcast is titled Truce in trade and dollar domination

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!