Dollar/yen dipped on growing trade fears but recovered quite quickly. The pair seems to reflect the next Fed hikes rather than safe haven flows. Will this continue?

USD/JPY fundamental movers

More China tariffs

The Trump Administration is considering slapping a 10% tariff on no less than $200 worth of Chinese goods. The news rattled markets but not last too long. The safe-haven move in the yen was limited to a short period of time.

Final US GDP, durable goods orders, and trade

The US will publish its third and final GDP publication for Q1 which will likely confirm the relatively slower growth. Durable goods orders for May will provide an insight into the nearer past. The Fed’s favorite inflation measure, the Core PCE is projected to tick up as well.

Yet trade will remain center stage once again. Any news, positive, or more likely, negative, could have a broader impact on the safe-haven yen in markets.

There is one notable publication in Japan, the Tokyo Core CPI for June. Back in May, it stood at 0.5% y/y and it is unlikely to advance too much.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

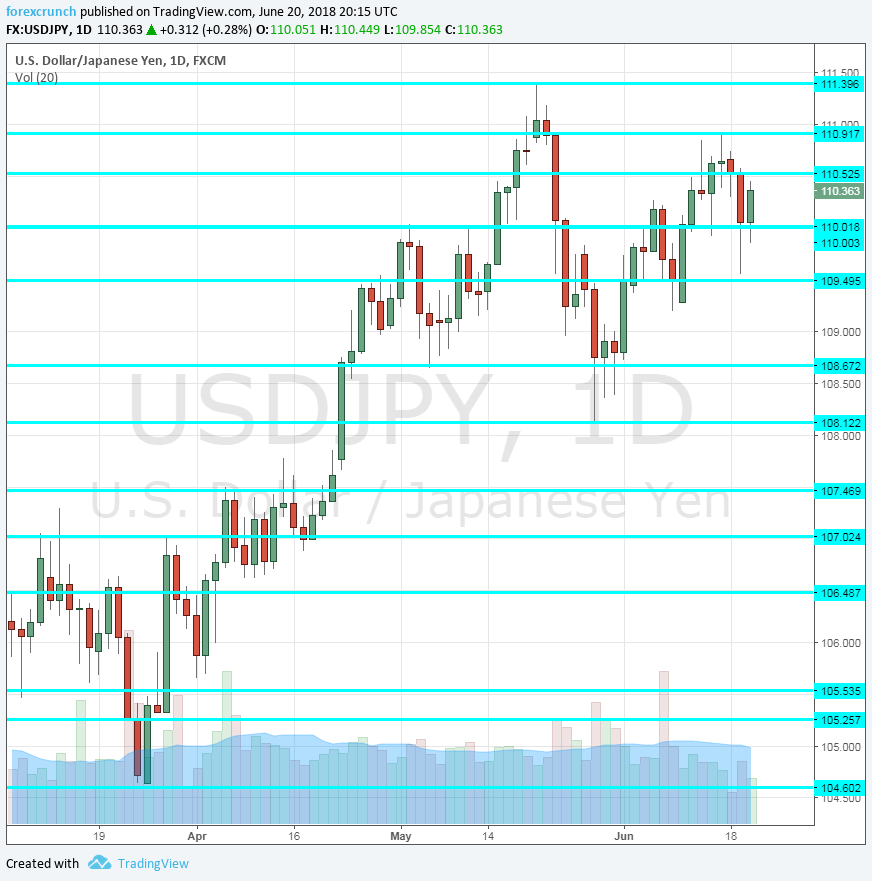

112.20 supported the pair back in December. It is followed by 111.40 which capped the pair in mid-May.

Further down, 110.90 was a high point in February. The round number of 110 serves as a psychological level. 109.50 held the pair back in late April.

109 was a pivotal line within the range. 108.70 was a stepping stone on the way up. 108.10 was a low point in late May and serves as a support line.

Lower, we find 107.50 capped the pair in early April and is a strong line.

106.50 was a resistance line in mid-February. and then resistance in early March. 105.55 was the first swing low.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

Unless there is some climbdown by Trump, the worsening situation will eventually catch markets unguarded and this could benefit the ultimate safe-haven, the yen.

Our latest podcast is titled Truce in trade and dollar domination

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!