Dollar/yen fell to new lows but pared most of its losses in a week that saw fears about Italy leap and also trade remained in the forefront. What’s next? US data provides a potential for movement but trade worries will likely remain a concern/

USD/JPY fundamental movers

Italy, trade, and Trump-ed NFP

The danger of Italy leaving the euro-zone and thus triggering a wide global crisis rose to the highest levels in many years. The crisis erupted when the President rejected a Euroskeptic finance minister, Savona, and criticism erupted. A new round of elections would have brought a stronger majority for the anti-establishment parties and would have been seen as a de-facto referendum on the euro-zone. This was eventually avoided as a compromise was reached. Nevertheless, the new government may still cause trouble for Europe.

The crisis prompted a surge in the yen, the ultimate safe-haven currency. Then came trade. The US implemented tariffs on steel and aluminum on Canada, Mexico, and the EU. This aggravated global tensions. There is a growing fear that these trade wars will result in weaker global growth. The issue will continue playing out.

The US jobs report was quite upbeat as the economy gained 223K jobs, better than expected. And while wages did not exceed expectations on a yearly basis, they still increased by 0.3% and the annual pace ticked up to 2.7%. This helped the pair rise toward the end of the week.

ISM Non-Manufacturing PMI, North Korea, and trade

The outstanding figure on a relatively lightweight calendar is the ISM Non-Manufacturing PMI published on Tuesday. As the NFP is already out, the report will have its own space. An increase is expected. In addition to the lack of top-tier figures, there will be no Fed speeches as they are already in a blackout period ahead of the decision in the following week.

Preparations are also going on for the reinstated Trump-Kim Summit. Any ups and down can impact the safe-haven Japanese yen.

The G-7 came out against America’s behavior on trade, which has worsened with all the world. The new tariffs on steel and aluminum may be joined by tariffs on Chinese tech. Japan is not only a safe haven but also dependent on trade.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

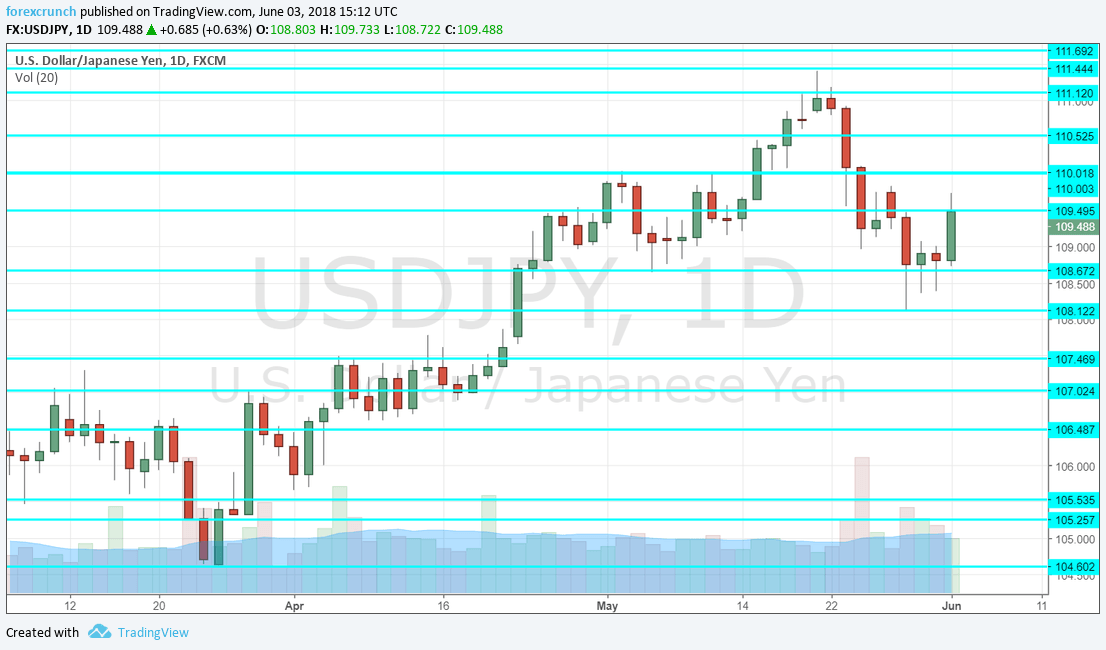

112.20 supported the pair back in December. It is followed by 111.40 which capped the pair in mid-May

Further down, 110.50 was a swing high in February. The round number of 110 serves as a psychological level. 109.50 held the pair back in late April.

109 was a pivotal line within the range. 108.70 was a stepping stone on the way up. 108.10 was a low point in late May and serves as a support line.

Lower, we find 107.50 capped the pair in early April and is a strong line.

106.50 was a resistance line in mid-February. and then resistance in early March. 105.55 was the first swing low.

USD/JPY Daily Chart

USD/JPY Sentiment

I remain bearish on USD/JPY

The looming trade war is not fully priced in. The safe-haven yen could receive more flows even if US data continues beating expectations.

Our latest podcast is titled Truce in trade and dollar domination

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!