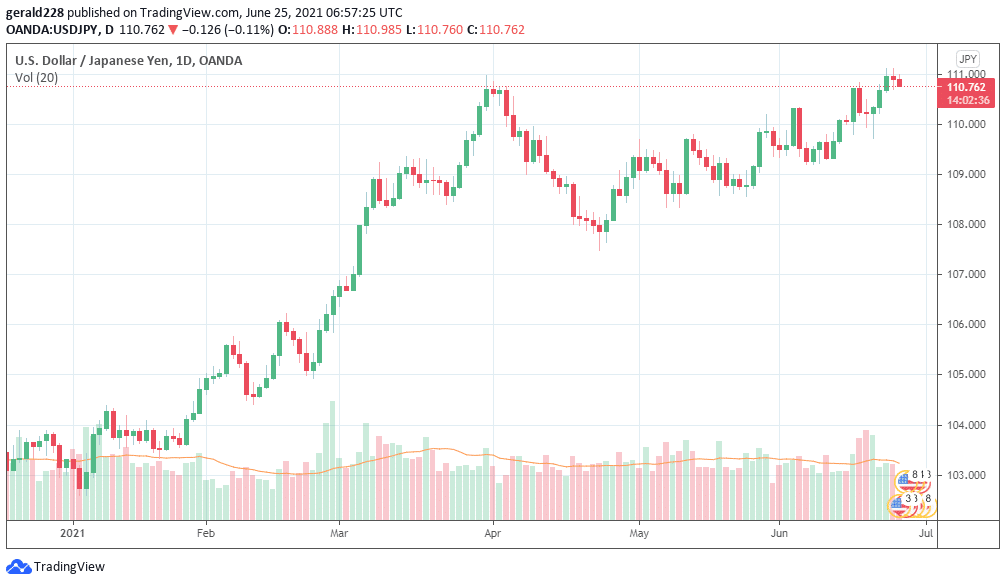

The USD/JPY continues to reach new highs and is on the up although it did close slightly lower as of yesterday. After a busy day full of data, the trading pair was slightly down at just under the $111 mark at $110.87. Several factors appear to be in play once again but slightly disappointing US data is possibly a factor in the slight reversal.

Actually, the USD/JPY closed with a slight reversal from the upper line of a short-term trend channel. It was also slightly down from a three-month horizontal climb.

USD/JPY: Optimistic Sentiment Easing

At one point, the USD/JPY set a high above the $111 level which is the highest it has been since the beginning of the year. However, a number of factors seem to have put a damper on the initial enthusiasm this week. The Asian markets have produced mixed results with European indexes mostly going down. US Treasury yields are also flat with very little movement on that front.

US Fed Reserve Chairman Jerome Powell’s testimony did not change much for the USD/JPY trading pair. He confirmed that the Fed was expecting a strong economic recovery whilst also playing down concerns on higher inflation.

Covid19 Concerns Continue For Tokyo

On the Japanese front, the Covid19 situation remains of concern. An extremely slow vaccination rate has left the country facing a possible resurgence of the virus with the Delta variant spreading fast. Additionally, the continued discussion on the Olympics has created more uncertainty with conflicting opinions on how many visitors should be allowed into the country.

Manufacturing data for Japan was also below expectations. The preliminary estimate for the Jibun Manufacturing PMI for June was registered at 51.5. That was down from the expected 52.3. On a positive note, the April Leading Economic Index was reviewed sharply up to 103.8. The Coincident Index for June was at 95.3. Later on in the day the US session will reveal the preliminary estimates for the June Markit PMIs.

USD/JPY Price Forecast – Strong Bullish Tendency

As events continue to pick up pace, the USD/JPY pair remains bullish in the short term. Technical indicators are showing indicators that are heading higher and there is no sign of the bulls tiring out either. The pair continues to advance ahead of its MA. An immediate resistance level of around $111.20 is the next text for the trading pair. Major support levels are around $110.90 and 110.50 whilst Resistance is at the 111.20 and at the very top, 112. Altogether the indicators are for a continued and sustained rise.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.