Dollar/yen hit new highs for the year in the upper 113s after the Fed raised rates and maintained its hawkish bias, despite some jitters. Is 115 next? The full buildup to the Non-Farm Payrolls is next.

USD/JPY fundamental movers

Fed hike

The Federal Reserve hiked interest rates to a maximum of 2.25% as broadly expected and continued signaling another increase in December and three more in 2019. The greenback initially dropped on the removal of the words “accommodative policy” that seemed to signal a slowdown in the pace of rate hikes. However, Fed Chair Jerome Powell clarified that the outlook has not changed and sent an overall upbeat message on the economy.

The US implemented the trade tariffs on China and this came and went quietly. The calm atmosphere allowed for a sell-off in the Japanese yen, a safe-haven currency. US GDP was confirmed at 4.2% in Q2 and durable goods orders data was mixed. End-of-quarter jitters sent the dollar temporarily down.

NFP buildup

The first week of the month begins with a full buildup to the all-important jobs report. The ISM Manufacturing PMI on Monday, the ADP NFP on Wednesday, and the ISM Non-Manufacturing PMI on the same day all set the stage for the jobs report. Wage growth is expected to accelerate to 3% and jobs growth carries expectations of a slightly weaker gain than last month’s 201K.

In addition, jitters about trade and talks with North Korea could impact the yen.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

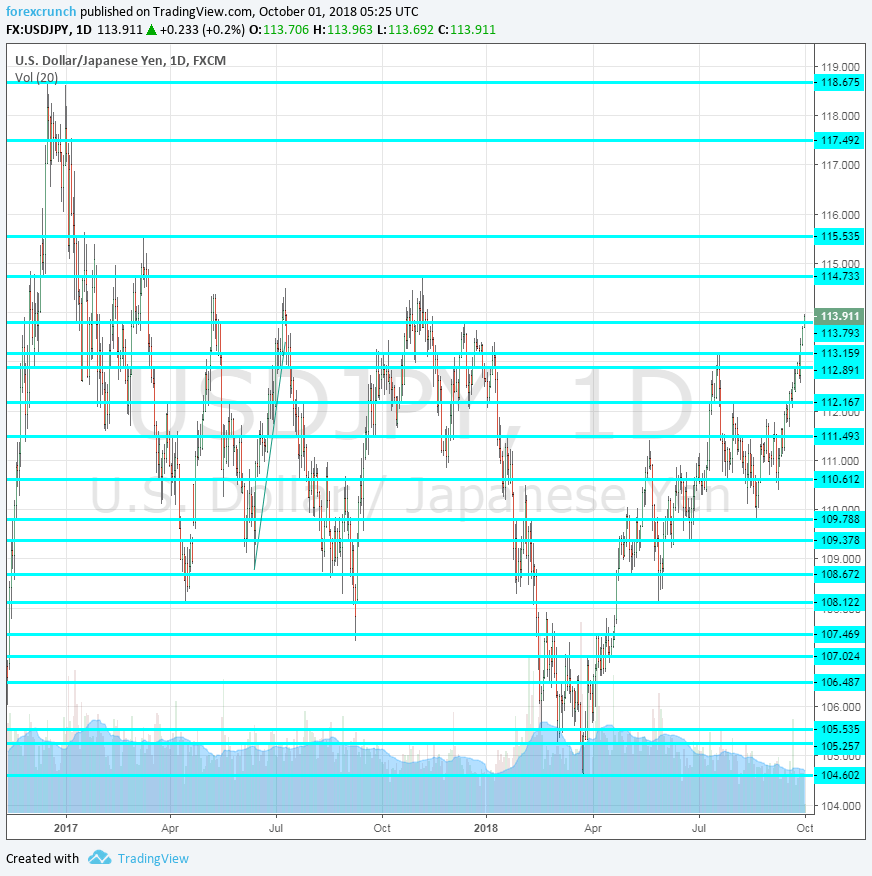

115.55 was a high point in the first half of 2017 and is an upside target.

114.70 capped the pair in December and is the next resistance to watch. The round number of 114 is closely watched.

113.15 is the high point seen in July. 112.80 held the USD/JPY down in mid-September. 112.45 was a stepping stone for the pair when it traded on such high ground. 112.15 was a swing high early in the month.

111.80 was a peak in the dying days of August and serves as resistance. Close by, 111.50 capped the pair beforehand and is another barrier.

110.60 was a swing low in late July and then again in late August. 109.70 was a swing low in late August and provides extra support below the round 110 level.

Close by, 109.35 was a cushion in mid-July. 108.70 was a cushion early in the summer and 108.10 a swing low in late May.

Lower, we find 107.50 capped the pair in early April and is a strong line.

USD/JPY Daily Chart

USD/JPY Sentiment

I remain bullish on USD/JPY

Without any significant drop in stock markets, the pair has room to rise on the Fed’s hawkish stance.

Our latest podcast is titled Too hot or too cold? The world is watching the Fed

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!