- Goldman Sachs no longer anticipates the Fed to raise interest rates in March.

- The SVB collapse could mean a smaller Fed hike.

- The Bank of Japan maintained ultra-low interest rates on Friday.

Today’s USD/JPY forecast is bearish. The dollar dropped on Monday to the lowest level in a month after Goldman Sachs said it no longer anticipates the Fed to raise interest rates at its meeting on March 22. It had earlier projected an increase of 25 basis points.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Investors assumed the Fed would now be reluctant to hike interest rates by a massive 50 basis points this month due to the collapse of Silicon Valley Bank. Investors will now watch Tuesday’s inflation numbers closely to determine how hawkish the Fed will likely be.

The Bank of Japan (BOJ) maintained ultra-low interest rates on Friday. It delayed any changes to its unpopular bond yield control policy, leaving options open before a leadership change next month.

During his last policy meeting, some investors unwound bets that the departing central bank governor, Haruhiko Kuroda, would adjust the yield curve control (YCC).

While Kuroda’s enormous stimulus is credited with rescuing the economy from deflation, it has put pressure on bank earnings. It also altered how the market operates due to persistently low interest rates. Moreover, the economy of the nation has only seen a shaky recovery.

Most economists believe the BOJ will abandon its yield control strategy this year, and half believe Ueda will change the policy within the next three months.

USD/JPY key events today

There won’t be any significant economic releases from Japan or the US today. Investors will keep watching developments on the Silicon Valley Bank’s collapse.

USD/JPY technical forecast: Collapse pauses at the 134.00 key level

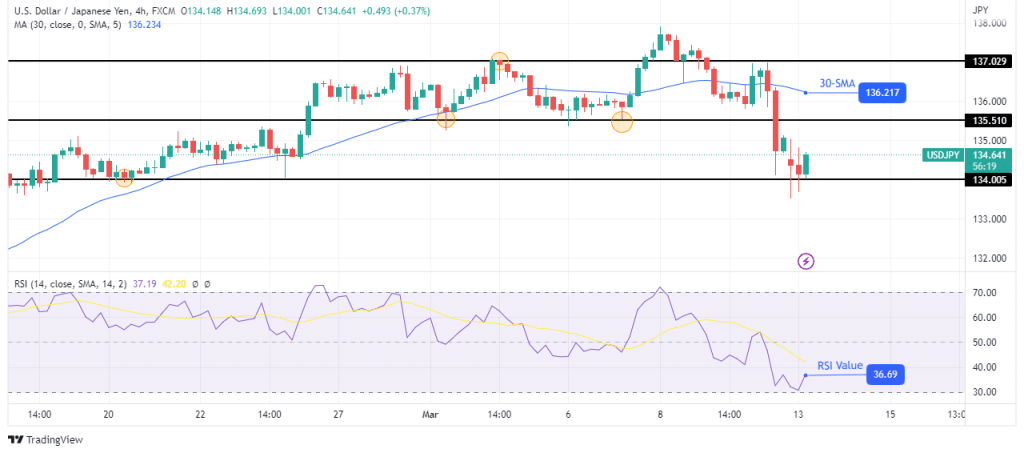

The 4-hour chart shows USD/JPY trading far below the 30-SMA, with the RSI just shy of the oversold region. The strong bearish momentum has led to a price collapse from the 137.02 level, breaking below the 135.51 support and pausing at 134.00.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

We might get a small consolidation or a pullback at the current level as the price reaches the 134.00 level as support. However, given the strong bearish momentum, we might soon see the price take out the 134.00 level to make a new low.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money