Key news updates for USD/JPY

Updates:

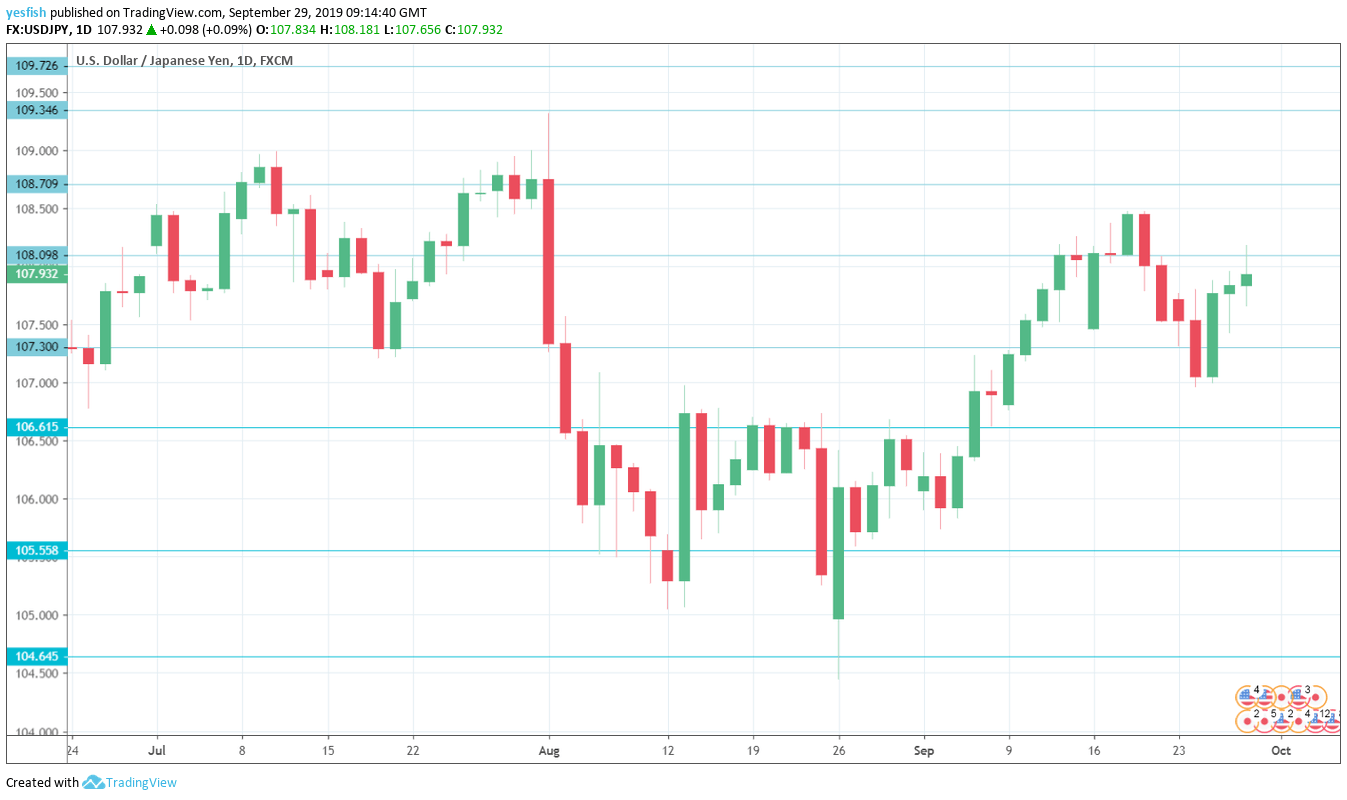

USD/JPY Technical Analysis

We start with resistance at 111.62. 110.62 is next.

109.73, held in resistance since the end of May. 109.35 is close by.

108.70 follows.

108.10 is an immediate resistance line. It has weakened USD/JPY continues to gain ground.

107.30 is providing support.