- The Fed surprised markets with higher-than-expected interest rate projections.

- The BoJ maintained its ultra-loose monetary policy.

- Investors are scrambling for the safe-haven dollar after Putin’s speech.

Today’s USD/JPY forecast is bullish. Just hours after the Federal Reserve shocked the markets with hawkish interest-rate projections, the Bank of Japan continued its ultra-easing stimulus, sending the US dollar to a new 24-year high against the yen.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

The BOJ maintained negative short-term rates and kept the yield on the 10-year government bond at or near zero, reinforcing market expectations that Japan’s central bank would continue to swim against a global tide of monetary tightening despite a weaker yen. The yen experienced a wild ride immediately following this decision.

“The market will be nervous, there will be some volatility for a while, but eventually, over the medium term, the weak yen trend will continue,” said Tohru Sasaki, head of Japan market research at J.P. Morgan in Tokyo. “The 1998 peak was at 147.60, so the market will look at that level.”

The Fed released new forecasts on Wednesday, predicting that rates will peak at 4.6% in 2023 and won’t be reduced until 2024. As was expected, it increased its target interest rate range by 75 basis points to 3.00%-3.25%.

Demand for safe-haven assets, which increased after Putin stated he would activate reserve troops to fight in Ukraine, helped to bolster the dollar. Putin threatened to use all of Moscow’s formidable arsenal if the West continued its “nuclear blackmail” strategy over the situation there.

USD/JPY key events today

Investors will be keen on the Initial Jobless Claims report from the United States. However, the markets will likely continue reacting to the aftermath of the central bank decisions.

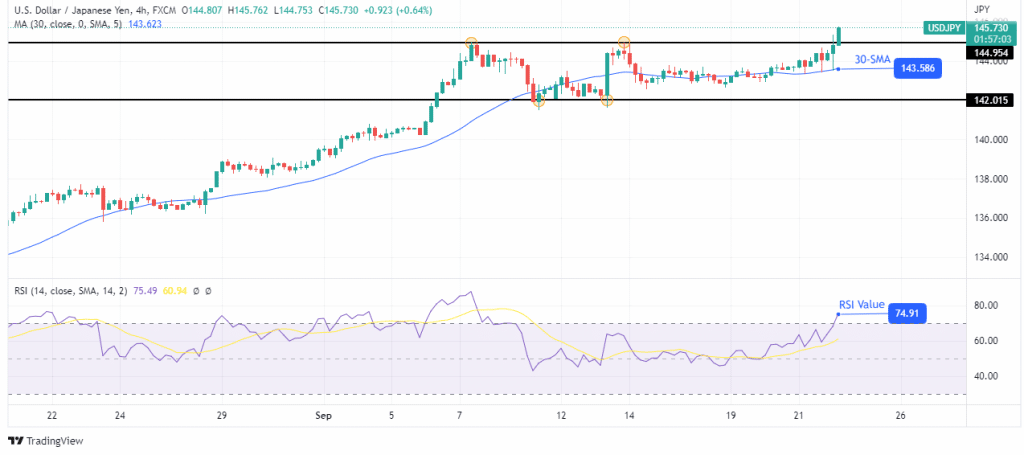

USD/JPY technical forecast: New highs with overbought RSI

Looking at the 4-hour chart, we see the price trading well above the 30-SMA and the RSI in the overbought region. After consolidating for some time with resistance at 144.954 and support at 142.015, the price has finally picked aside. Bulls have won by pushing the price to break above the resistance level at 144.954.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

The price will likely make a new high above this resistance before retesting it as support. Bears will probably return shortly for a pullback as the price is overbought before the uptrend continues.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.