Dollar/yen dropped to new 15-month lows as Trump sparked fears of a trade war and despite Powell’s hawkish sounds. What’s next? The Non-Farm Payrolls and their buildup in the US meet the BOJ decision in Japan, now that Kuroda is not afraid to mention the exits.

USD/JPY fundamental movers

Powell gives, Trump tarnishes

Fed Chair Jerome Powell tried to express cautious optimism but when asked a direct question about the dot-plot, the new Chair did say that things have improved since the last projection. In addition, he later said that four rate hikes would still be considered gradual. This supported the dollar.

On the other hand, US President Donald Trump announced tariffs on steel and aluminum, spooking markets that fear a trade war. The safe-haven yen found demand. The tough talk continues for another week.

In addition, BOJ Governor Haruhiko Kuroda surprised by saying that the BOJ may begin removing stimulus in fiscal year 2019, which begins in April 2019. While he conditioned it on inflation, the first such talk about the exits surprised markets and strengthened the yen.

NFP, BOJ and more Trump trade talk

The Non-Farm Payrolls on Friday is expected to yield a gain of around 200K once again and once again, wages will take center stage. A monthly rise of 0.3% is projected. Ongoing higher salaries are needed to convince the Fed that inflation is coming.

The meeting by the Bank of Japan became more important after Kuroda’s recent comments. They convene on Friday.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

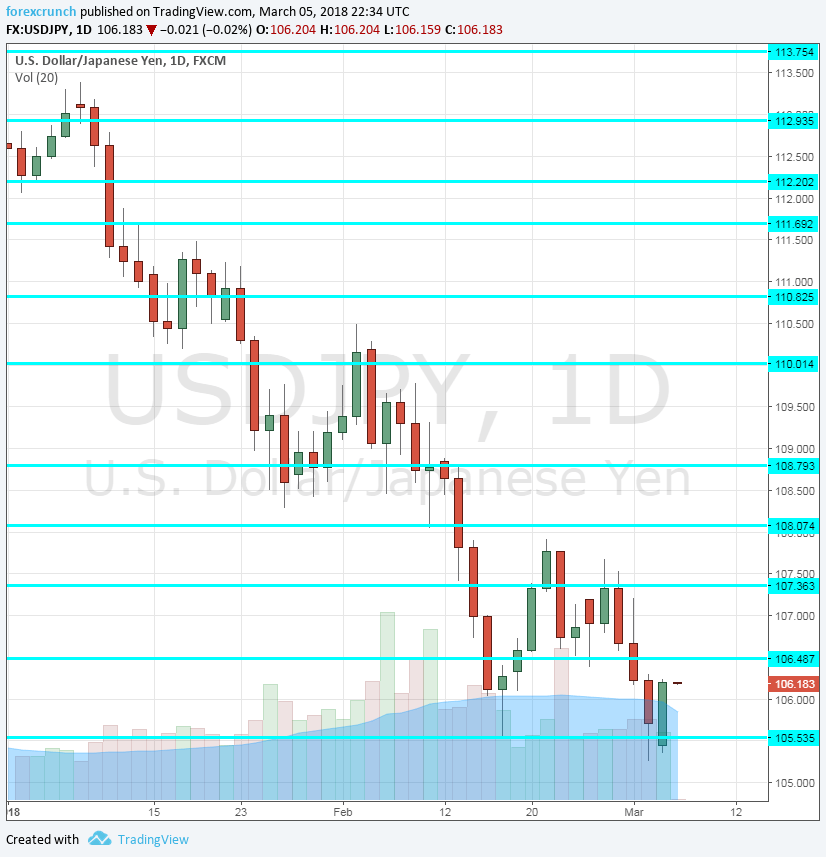

112.90 served as support in December and is a pivotal line in the range. 112.20 used to be important in the past.

It is closely followed by 111.70, which provided support back in October. The round level of 111 worked as a cushion to the pair in November.

Looking down, 110.70 was a separator of ranges in June and remains important. The round number of 110 serves as a psychological level.

109 was a pivotal line within the range. 108.30 was the low seen in late January. Even lower, we find 107.30 was the low in September and now turns into resistance.

106.50 was a resistance line in mid-February. The 105.25 low is the next line to watch, serving as a low point around the same time.

If the pair falls even lower, the round number of 105 will come into play, followed by 103.30.

USD/JPY Daily Chart

USD/JPY Sentiment

I remain bearish on USD/JPY

The BOJ is not really nearing the exits as inflation is not nearing its target. In addition, Trump’s ongoing tweets may keep markets on the edge, and this scenario is favorable for the US Dollar.

Our latest podcast is titled When everything sells off, where is the money going to?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!