- Risk rebound is weighing heavily over the anti-risk JPY.

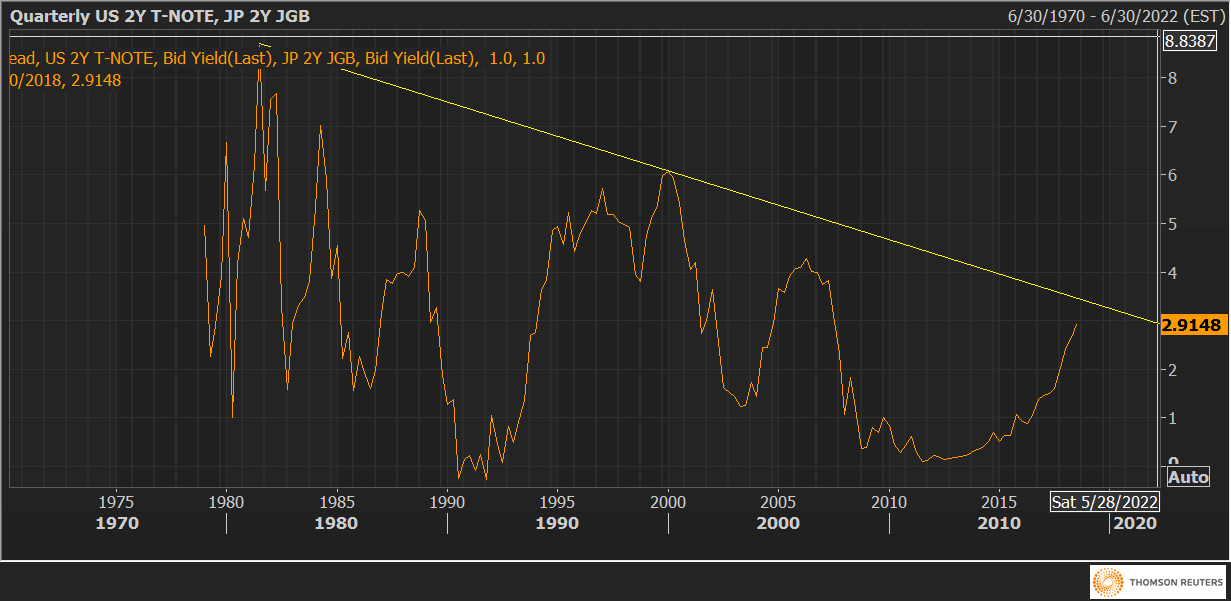

- The two-year yield differential continues to widen in a USD-positive manner despite better-than-expected Japanese CPI data.

The USD/JPY is bid around 112.50 and may rise to 113.00 during the day ahead on easing trade concerns and rising US-Japan yield differentials.

China’s watered-down response to new US tariffs earlier this week has likely raised hopes that further escalation of a trade war between the US and China can be avoided. As a result, the risk assets have put on a good show this week. For instance, the Dow closed at a record high yesterday and the Euro Stoxx 50 jumped above 3400.

More importantly, the spread between the US two-year treasury yield and its Japanese counterpart widened to 292 basis points Friday – the highest level since September 2007 – despite an above-forecast Japanese CPI reading for August.

Looking forward, the yield spread could continue to rise in the USD-positive manner, as the Fed is likely to raise rates by 25 basis points next week.

USD/JPY Technical Levels

Resistance: 113.00 (psychological hurdle), 113.23 (200-week MA), 113.75 (December 2017 high)

Support: 112.29 (ascending 5-day MA), 112.15 (Aug. 1 high), 111.66 (Sept. 18 low)

2Y spread